Jason and Emilia discuss finding the people who connect us to the important relationships in our lives. They also answer questions from one of Jason’s recent webinars.

Click here to read the full article on Charlie Munger: www.cnbc.com/2019/02/21/95-year-old-billionaire-charlie-munger-says-the-secret-to-a-long-and-happy-life-is-so-simple.html

Below is the full transcript:

•••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••

Announcer: Welcome back America to Sound Retirement Radio where we bring you concepts, ideas and strategies designed to help you achieve clarity, confidence and freedom as you prepare for and transition through retirement. And now here is your host Jason Parker.

Jason: America. Welcome back to another round of Sound Retirement Radio. So glad to have you tuning in this morning. It’s my good fortune to have Emelia Bernal in the studio with me. Emelia, welcome back.

Emilia: Thank you Jason. Good to be back.

Jason: What episode number are we on today?

Emilia: We’re on 194.

Jason: 194.

Emilia: Getting close to 200.

Jason: Did we come up with a title for this thing?

Emilia: We did. Your Relationships and Questions.

Jason: Oh yeah. This is gonna be a good one, I’m looking forward to it. Okay. But before we do, let’s get the morning started right two ways. The first is by renewing our mind and this comes to us from Galatians 6:9. “Let us not become weary in doing good for at the proper time we will reap a harvest if we do not give up.” That’s pretty cool.

Emilia: Nice. And here we go. So this is actually really nice. So we’ve had recently I think my jokes are just that bad but we’ve had some listeners send in some jokes so I’ve been really excited to share some of these so I have one from one of our listeners named John.

Jason: All right. John. Thank you.

Emilia: Yeah. And I laughed as soon as I opened it.

Jason: Helping the cause.

Emilia: Thank you. Yes. So here we go. What do you call a seagull that lives in the bay?

Jason: I don’t know.

Emilia: A bagel.

Jason: That’s pretty good. That is pretty good.

Emilia: I like that one.

Jason: Wait wait, I got another one for you. My daughter told me this one. And she’s so funny. When the kids they tell you these jokes, they look at you like I don’t know if I should say this or not. So you guys might be offended. But why did Spider-Man pick his nose?

Emilia: I don’t know.

Jason: To get the Green Goblin.

Emilia: Oh gosh.

Jason: Only from the lips of an 11 year old.

Emilia: Oh yeah.

Jason: You gotta love it.

Emilia: That is so funny.

Jason: Okay so-

Emilia: Well that’s fun. All right so yes we were today … you’re going to keep laughing … the Green Goblin.

Jason: It’s ridiculous.

Emilia: So your relationships, we’ll start with that. So you had a couple of articles that you wanted to share with our listeners that really resonated with you and with our listeners, one of them you wrote yourself.

Jason: Yeah. Well and because I wrote this article for a local magazine here and then we posted it on Facebook and we had just a ton of people share it so I was like “Oh that’s interesting.” But what made me think about that article is there was a news piece that I just read this morning and we’ll link to this in the show notes but it says “95 year old billionaire Charlie Munger, the secret to a long and happy life is so simple.” And it’s Charlie Munger is giving his advice for living a happy life. So if people are interested in what he has to say about that. Now Charlie Munger people know, most people know it’s Warren Buffett’s right hand man. But what I found interesting about this article Emelia was this quote. It says “Nevertheless it was 1959 before I met Charlie, long after he had left Omaha to make Los Angeles his home. I was then 28 and he was 35. The Omaha doctor who introduced us predicted that we would hit it off and we did.” That’s what Buffett wrote I guess in his 2014 annual letter to shareholders.

Jason: And so what I thought about when I read this, of all of the stuff that was shared was that doctor that connected these two guys that have had this lifelong business relationship and lifelong friendship as a result of that doctor connecting them. And it reminded me of this article that I wrote that so many people had shared. So I thought everybody that listens to the podcast though they don’t necessarily read everything that I’m writing all the time so I wanted to share that article and I think I’ve got that here. So I’ll just read this and then we’ll talk about this idea of relationships before we get into some of the questions that people had submitted recently.

Jason: “So when I was growing up I always thought it would be fun to hike up a river and try to find its origin. Several years ago I was on a hike in the Olympic Mountains when we came upon water that was just bubbling up out of the ground. And a friend of mine explained that this bubbling brook is the headwaters of the Big Quilcene River. To be at the very beginning of a river was so exciting to me. I felt like I could check off one of my childhood dreams.

Jason: Since that hike I’ve often thought about the headwaters of relationships, the genesis of how people come into my life, who are the connectors that bring us together. A fun exercise is to identify someone in your life and then trace back how that relationship came into existence. For example I had the good fortune to have a mentor for my career, a man named Dean. I met Dean because I was looking to make a career change so I called my dad and I asked him if he knew of any opportunities I might consider. My dad had a friend who was working for G.E. Capital. I contacted this friend and he connected me with the Regional Manager out of Seattle. The Regional Manager connected me to the District Manager in Silverdale who was Dean. My friendship with Dean turned out to be one of the most influential for my career. My dad was the one who I could trace the beginning of that relationship. And it turns out that my dad is one of the major connectors in my life.

Jason: The Pareto principle is often known as the 80/20 rule and it states that 80 percent of the output is determined by 20 percent of the input. As I think of the friends I have today, I have found that the majority of my friends can be traced back to just a few people. These people are the connectors. They are the genesis, the headwaters for friendship. Could it be that 20 percent of the people in my life are responsible for 80 percent of my friendships?

Jason: If we can identify and focus on the few people who are most responsible for the relationships in our lives then we may have discovered the secret to living an enriching life full of friendships, adventures and memories we make along the way.”

Jason: That was the article I wrote for the magazine that people apparently shared quite a bit.

Emilia: Yeah and I don’t know if I told you this. I actually had Rubin read this one when I saw it posted.

Jason: Did you really?

Emilia: Yeah. For some reason it really did stand out. I was like “This is different” and I told him, I said, “You should read this.” And he enjoyed it.

Jason: So have you done this exercise? Have you thought about some of the people in your life and how you’re connected to them, how that relationship originally came to be?

Emilia: Yes and I think about that a lot and just like you I find myself … my dad is one of those people. He’s one of my main connectors.

Jason: Is that right?

Emilia: Even for example today, he keeps me connected to my family back home. He’s probably the person I speak to the most. So he texted me just today saying that one of my cousins was going to be in the area and that I should send him my address. And so this is a distant cousin but somebody that he’s like … he’s just keeping me in the loop and just reminding me that there’s other people out here even that I’m so far away from home that I can stay connected to. Or if they’re here they can … people that have actually moved here too, he does the same thing. He’s like “Oh so-and-so just moved to Seattle, you should reach out.” And that’s just great cause he’s got that … that’s in him, he’s always about relationships and everybody knows him back home. So it’s kinda neat.

Jason: Wow, that is cool.

Emilia: Yeah.

Jason: So I’ve done this exercise and I’ve actually been able to identify three people that are responsible for most of the relationships in my life. My dad is number one. Now what’s interesting is I wouldn’t know my wife if it weren’t for my dad. My dad said, when I was 18, he said, “Hey look, I’ll pay for you to go on this snowboarding trip with the church if you’re interested in going.” At the time I really didn’t want anything to do with the church but I wanted to go snowboarding so I said “Yeah I’ll go.” And then that’s when I met with my wife on this church outing. My girlfriend for four years before we got married. But had my dad not been the one that encouraged me and paid for that snowboarding trip I never would have met my wife and so my wife is a major connector for me. So most of the friendships we have today if it weren’t for her I’d be like a hermit living in a cave somewhere. I don’t know, I wouldn’t know anybody.

Emilia: I feel the same way about my husband. He’s the social butterfly. I’m more the quiet one.

Jason: He is the social one. He’s so funny. He gets so excited and you can just tell he loves people.

Emilia: He does.

Jason: I always like when I get to spend time with him.

Jason: And then Dean. Dean was another huge connector for me. I mean the business and all the relationships I have or many of the relationships I have today are a result of my mentor Dean and my friend Dean. So those three people.

Jason: And then when you lose one like I lost my friend Dean and you just realize now there’s not just this void of this one friendship but all those people that he connected me to. And so anyway, it’s just a really fun exercise and that’s why I geeked out a little bit when I read the story about Warren Buffett, that doctor. I just wonder how … I wonder if that doctor is the connector in other people’s lives too. And I’d really be interested in learning more about that story. So that’s all I had and for our listeners drive down the street this morning, it really is fun. Next time you’re standing in the shower just think of somebody you know and try to trace back, connect all of the dots to how that relationship originally came to be and see if you notice a trend where certain people are responsible for your relationships.

Jason: And one of things I know Emelia and you know this too but life is better together. It is a lonely place all by yourself. In fact I believe that’s one of the tools of the enemy is to try to get people isolated and alone. And if we can get them connected and in relationships man life’s just better that way.

Emilia: So just speaking of connectors and other ways that we connect with our people, our listeners, is we want to give you a reminder that we still have the offer open for the book.

Jason: Yes.

Emilia: Signed by Jason. So again if you go to Amazon, purchase the Kindle version of the book and then you leave us a review and just an honest nice review would be great and then you can go to SoundRetirementPlanning.com and there’s an offer there to get the free copy of the actual paperback book signed by Jason. So it’s a great offer, we’ll still be going through I think you said maybe March will be the end of that.

Jason: Well that’s when the price of the Kindle book is going to go up significantly. We wanted to give our tribe, our audience, our listeners, the best deal, but come I’m thinking March 15th we’re going to crank the price back up to the normal price for the Kindle book. So if they’re interested in reading the book they should get it now when it’s still a better deal.

Emilia: Yes. Great deal. All right, so again our topic for today was your relationships and questions. So Jason recently had a webinar and we often get a lot of questions and so we wanted to take the chance to have Jason answer some of these questions for our listeners.

Jason: Yeah. And the reason Emilia, I know if one person asks a question you’ve got probably at least 10 other people with the same question that just don’t ask it. So these are all really good questions. And we have people from all over the country and while we all want to think that our situation is so unique, we’re actually very similar. And so I bet you as we go through these questions this will resonate with folks. But go ahead and what was the first one?

Emilia: All right. So the first question we have is “Is there a way to create an annuity like investment for yourself not using an insurance company?”

Jason: Yeah. And that was such an interesting question to me. This guy is saying “Look I want what an annuity would provide. I want guaranteed income but I want to do it without an insurance company, is there a way to do that?”

Emilia: That is an interesting question, I don’t think I’ve ever heard that one.

Jason: Yeah. And one of things I think about is well if there’s a tool that exists that will do what you want it to do and that’s what it’s designed for, why would you go out and try to figure out something else? Why wouldn’t you just use the tool that’s available to you? So for example the way I thought about this is like I go to the store and I buy a drill and I buy nails. And then I’m gonna go home and I’m gonna say “Instead of buying a hammer to put those nails in.” And that’s what a hammer is designed for. “I don’t like hammers and so I like drills but I don’t want to use screws, I want to use nails.” Now I’ve got these nails and this drill and I got to try to figure out how to put these two things together. Why wouldn’t I just buy the tool that’s designed to do what I need it to do?

Jason: And one of the things I shared with this gentleman on the webinar is I think part of the problem is in the world that we live in today, you have people out there that are on TV that are saying things like “I hate annuities and I would rather go to hell than to recommend you buy an annuity.” So that’s coming from one camp, that’s like the guys that are only doing investments. And then you’ve got the insurance guys, these guys that are only recommending insurance products and they’re saying “All of your money should be in an annuity.” And so there’s like, there’s no … I mean it’s just these two extremes and neither one of those are in my opinion the right way to approach this.

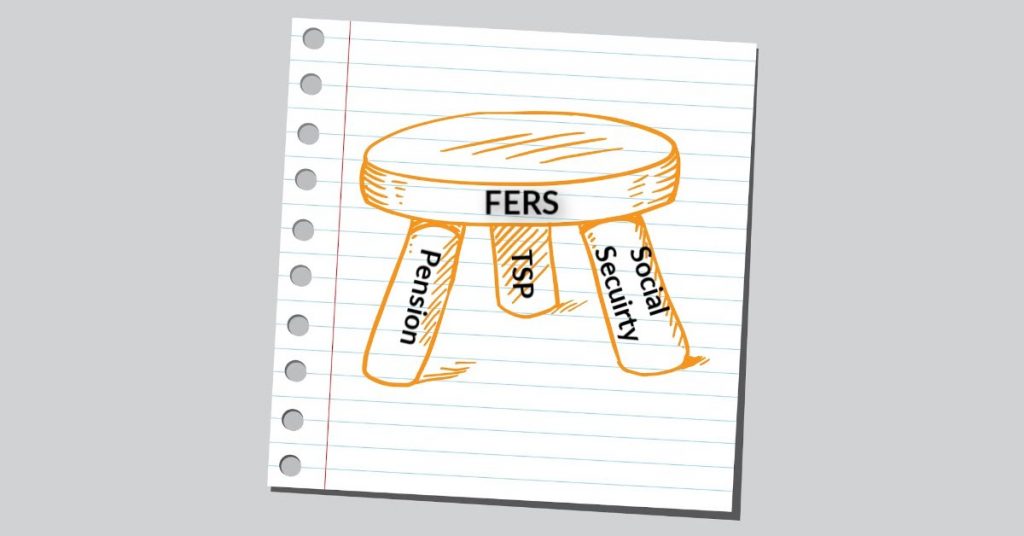

Jason: But the fact is the academic community, for example if you read Robert Shiller’s book, Robert Shiller’s a professor at Yale, he wrote a book called Irrational Exuberance. In the second edition of his book, I think it’s on page 293 he said, and it’s kind of weird that we’re in this environment today where people are so dependent on the stock market for our retirement because it used to be that when you worked for a company they didn’t give you a 401k, they gave you a pension when you retired. That’s what my grandfather had. So you worked and then you got guaranteed income.

Jason: So then the company said “Well you’re going to be responsive for your own guaranteed income” and an annuity contract, an immediate annuity, an income annuity, is the only tool that you can use the word guaranteed income. It’s the only financial vehicle where you can use the word guarantee and income. And it’s because life insurance companies can pool mortality rates and then they can say well based on the fact that we know some people are going to live a long time, some people are going to die early, you get these really attractive payouts from these annuity contracts. But it is just interesting that people want to try to find some sneaky different way to do this. But really the only way you can really guarantee income and know that it’s never going to go away as long as you’re alive is through the use of an annuity contract.

Jason: Now one of the reasons that doesn’t feel good to people because some of the … and these type of annuities still exist but the annuity what they say is that if you die, so let’s say you buy one of these immediate annuities and then you die two weeks after purchasing it. Well the money that you put into the contract could be lost and there would be nothing left for your beneficiaries if you bought an immediate lifetime only annuity. But there’s a lot of different ways to structure those so that that doesn’t happen. So you don’t have to be in a position where there’s nothing left for your beneficiaries. You can structure these as for a period certain with lifetime. Or a lot of annuities now have these living benefit riders on there. So there’s just a lot of different ways to structure it. And I think some people haven’t really fully researched with the way the tools work. So instead of just using the tool that was designed for that purpose they want to try to figure something else out.

Jason: Now the other thing I would say is it’s OK to not like certain financial tools. So if you don’t like annuities, if you don’t like mutual funds, if you don’t like ETFs, if you don’t like stocks, if you don’t like real estate investment trusts, if you don’t like mutual funds, if you don’t like money market accounts, whatever, you don’t like bank CDs, whatever, you cannot like anything and that’s OK. And your adviser should be able to help you design the plan that you want with the tools that you’re comfortable with. So if you go to an insurance guy and he says “Look, you should put all your money into annuities” and you say “Well I don’t really like the annuity option. What else do you have?” And the insurance guy’s like “I’ve got nothing else because that’s the only tool I’m licensed to offer.” Well then you’re just talking to the wrong person. It’s not that it’s a bad financial vehicle, you just aren’t talking to somebody.

Jason: If you go to the investment guy and you say “I’d really like to have some of this income guaranteed.” And he says “I’d rather go to hell than sell you an annuity.” Well you’re probably talking to the wrong person because he’s just trying to invest your money in and charge you a fee for the asset management. So I think you need to get it done the way that you want it done.

Jason: But the other way that you could do it is if you don’t want … if there’s certain financial tools you don’t want to use like you don’t want to use an annuity contract then you could … we’re big proponents of creating different buckets of when you need the cash. So if you need money in the short term, you just don’t want to take a lot of risk with that. So maybe you have like a five year bucket and then a five to 10 year bucket and so on. And so that would be another option for generating income in retirement. Reminding our listeners that retirement’s an exercise in cash flow, it’s all about your income. And I also want to remind our listeners that I developed the Retirement Budget Calculator.

Emilia: I was just going to say that.

Jason: RetirementBudgetCalculator.com. It’s a really great tool to help you understand your spending. But we should probably get onto the next question, I’ve really kind of hammered on this one.

Emilia: Yeah. So just on the Retirement Budget Calculator I want to remind our listeners that you still have the opportunity. We have a coupon code. If you go to RetirementBudgetCalculator.com and enter the coupon code PODCAST, all one word, you get a discounted price on that application. So it’s a great offer there too.

Jason: Super cool tool. And the other thing is we have a 30 day money back guarantee so if people buy the calculator and they’re like “Oh this wasn’t really what I was looking for” then they can just let us know and we’ll give them their money back. But one of the neat things about the budget calculator is it’s so much different than anything else that exists out there. It’s not like Quicken. It’s not like Mint. It’s not like YNAB. It’s not like Dave Ramsey’s Every Dollar app. This is a tool to help you look at cash flow on an inflation adjusted basis looking out into the future. So OK, question number two.

Emilia: So question number two. “If considering retiring early prior to Medicare eligibility do you help plan for costs for health insurance as a bridge to Medicare?”

Jason: Yeah this is such a great question because it’s such a big concern for so many people. Health insurance for many people that retire early that is their single biggest expense if they’ve paid off all of their debts, they have no mortgage, they have no car payment, then health insurance is usually their biggest expense every month. And even though at our firm we are insurance licensed, we do not recommend specifically health insurance.

Jason: Now from a planning standpoint what we do help people do is help them understand which pot of money they’re drawing their income from because if we keep their modified adjusted gross income low then they may qualify for some of the subsidies that are out there for health insurance. So maybe they’re pulling money out of a Roth IRA to keep their income low or maybe their pulling money out of non-qualified accounts that are already taxed to keep their income low. So they still have the cash flow coming in that they need but from a tax standpoint they don’t have a lot of taxable income and that could significantly impact the amount of their health insurance or how much they’re paying on a monthly basis for health insurance. So we help people think strategically but in terms of buying insurance you really need to find some … because it’s so specific to the state you live in, sometimes even the county you live in. You really need to find somebody that’s an expert in health insurance in your area and have them help you there.

Emilia: Great. So onto question number three. “Would the dollar amount of an IRA to Roth IRA conversion count as part of the RND?”

Jason: Yeah. So what this person is talking about is once you turn 70 and a half you are required to begin taking money out of your retirement accounts, your IRAs. And so their question is “Can I do a conversion at that point, take my minimum distribution and move it into a Roth IRA?” And the answer is no you cannot. You can still do conversions after age 70 and a half but it has to be any money above and beyond what the required minimum distribution would be.

Jason: So for example let’s say the minimum distribution is $10,000 that year. You can’t take the $10,000 and put that $10,000 into the Roth IRA. But if you wanted to convert money and let’s say you wanted to convert $10,000, you could take your minimum distribution of 10,000 and then you could do an additional conversion for the additional $10,000. So you’re going to end up with a $20,000 tax hit but it is still possible to do Roth conversions after 70 and a half. And this is a hot subject. Taxes are hot because we have some really low tax rates right now and people are saying “Geeze, I’ve got maybe eight years before this thing sunsets, should I be moving money out of these IRAs and 401ks and TSBs and 43Bs and into a tax free position?” So we’re hearing a lot of questions along those lines and I wish there was a blanket answer, an easy answer, but we really need to understand everybody’s specific situation before they do that.

Emilia: Yes. Great advice. So another question we have here. “Assuming a retirement age of 65, the distribution phase is at age 65. The accumulation phase is when you are young and middle age. Where do you want to be when you are between age 55 and 60? And age 60 to 65?” And it says “gradually less aggressive.”

Jason: Yeah so the guy’s basically … this question is just “Hey we’re not planning on retirement till 65, we’re still in accumulation mode, we haven’t started the distribution, and the distribution phase isn’t going to start until age 65.” But they’re starting to approach retirement. So what he’s wanting to know is what’s the right time to start taking their foot off the gas pedal of accumulation?

Jason: And really the best way to answer this one … and see what I found is most people are making investment decisions before they make planning decisions. You build the plan first and because when you build a plan what it helps you understand is what rate of return you need to earn in order to make the numbers work, not what rate of return you want to earn. And so I’ll never forget years ago we met with a gentleman and he had over saved for retirement and we found that if he could just earn 2 percent per year on his money as we projected that out, life was going to be really good for him.

Jason: So and then you don’t … I mean if you’re worried about risk and we know that depending on what your plan says, what rate of return, then we can start sculpting the asset allocation and the diversification around what return is needed. But that’s the key. Build the plan first, understand what rate of return you need to earn. And then we can do the risk tolerance questionnaire. We can say what are you going to be comfortable with if the market tanks 20-30-40 percent. Is that too much risk? Are you comfortable with that or what do we need this to do? And there’s a big difference between wants and needs.

Emilia: Yes. Do we have time for a couple more questions?

Jason: Maybe one more.

Emilia: All right. So let’s see here. “Can you explain more on the standard deviation relative to financial planning?”

Jason: Yeah. And this was something that we really emphasized in the last webinar was helping people understand the variance of returns around the mean, that’s what standard deviation is, it’s how wide of a swath the returns are around the average. And just showing people that volatility really can be disruptive to people in retirement. But not just volatility because it’s really more the sequence of returns that that volatility occurs. And even more important than that, if we help people create a structure that’s too aggressive, it’s too risky, it’s outside their risk/comfort zone, and then something bad happens and then they panic and they freak out and they head to cash or they say “I don’t ever want anything to do with this”, then we just blew up the whole retirement plan because they were being too aggressive in the first place.

Jason: Emelia I just met with people earlier today that are being way too aggressive in some of their accounts and they didn’t even know it. I mean it was one of the reasons they came in was because they were looking for a second opinion. And yeah it was an eye opener for them when we stress tested that. And we built the plan first and we said “Well geez, why are you taking on all this risk?” And they’re like “We don’t know, we don’t know what we’re doing.” And so, a lot of people out there in that position.

Jason: But with that Emelia I realize we are out of time.

Emilia: All right. Thank you.

Announcer: Information and opinions expressed here are believed to be accurate and complete, for general information only and should not be construed as specific tax, legal or financial advice for any individual and does not constitute a solicitation for any securities or insurance products. Please consult with your financial professional before taking action on anything discussed in this program. Parker Financial, its representatives or its affiliates have no liability for investment decisions or other actions taken or made by you based on the information provided in this program. All insurance related discussions are subject to the claims paying ability of the company. Investing involves risk. Jason Parker is the President of Parker Financial, an independent fee based wealth management firm located at 9057 Washington Avenue NW. Silver Dale Washington. For additional information call 1-800-514-5046 or visit us online at SoundRetirementPlanning.com.