In today’s podcast, I’m excited to share what I am calling the Pyramid of Investing Success. We will begin by exploring the foundation of the pyramid and then progress layer by layer until we reach its pinnacle.

If you enjoy todays podcast be sure to share it with a friend and leave us a 5 star review.

The Retirement Budget Calculator is an intuitive tool that promises ease and accuracy. However, like any tool, user error could potentially lead to costly mistakes. To avoid this, let the experienced advisors at Parker Financial LLC guide you.

When you hire our team, we offer a comprehensive review of your current investments, taxes, and the data in the Retirement Budget Calculator. We will ensure your plan’s completeness and accuracy, helping you create an investment strategy, assist with tax planning, and monitor your plan to maximize your retirement benefits.

At Parker Financial we offer a well-crafted retirement investment strategy, deeply rooted in academic research and financial science which can be the key to a prosperous retirement.

Don’t leave your future to chance. Take the first step towards a sound retirement. Schedule your complimentary discovery session now by visiting Parker-Financial.net let us help you make the most of your retirement years.

Articles, Links & Resources:

Book: Wooden A Lifetime of Observations on and off the Court

RetirementBudgetCalculator.com

The Benefits of Global Diversification

CIRANO: Value of Financial Advisors

Transcript:

433 The Pyramid Of Investing Success

Announcer: [00:00:00] Welcome back America to Sound Retirement Radio, where we bring you concepts, ideas, and strategies designed to help you achieve clarity, confidence, and freedom as you prepare for and transition through retirement. And now here is your host, Jason Parker.

Jason Parker: America, so glad to have you tune in into episode number 433.

The title of this episode is the Pyramid of Investing Success. But before we get into the show, I always like to start out by renewing our mind and I’ve got a verse here for us from Colossians chapter one, verse nine. For this reason, since the day we heard about you, we have not stopped praying for you.

We continually ask God to fill you with the knowledge of his will through all the wisdom and understanding that the spirit gives. And then something fun for the grandkids. Why do bananas use sunscreen during the summer? Because [00:01:00] they peel. In today’s show, I’m going to share with you what I call the pyramid of investing success.

And just as a reminder, articles, links, and resources can be found at soundretirementplanning. com. Just click on episode number 433. I had the privilege of coaching my son’s basketball team from the ages of nine to 12. And I wanted to know how to be a better basketball coach. So, I read the book, Wooden.

Coach Wooden is considered by many to be one of the greatest college basketball coaches of all time. Some of the legendary players that he coached were Kareem Abdul Jabbar and Bill Walton. And I laughed when I read that Coach Wooden started the first practice of every season by teaching his players how to put on their socks and tie their shoes.

Can you imagine Kareem Abdul Jabbar being told how to put on his socks and tie his shoes? Coach Wooden’s belief was that you had to coach people on the fundamentals and teach them the basics. If his team did not know how to put on their socks [00:02:00] and tie their shoes, it could result in blisters or injuries, and would prevent them from playing.

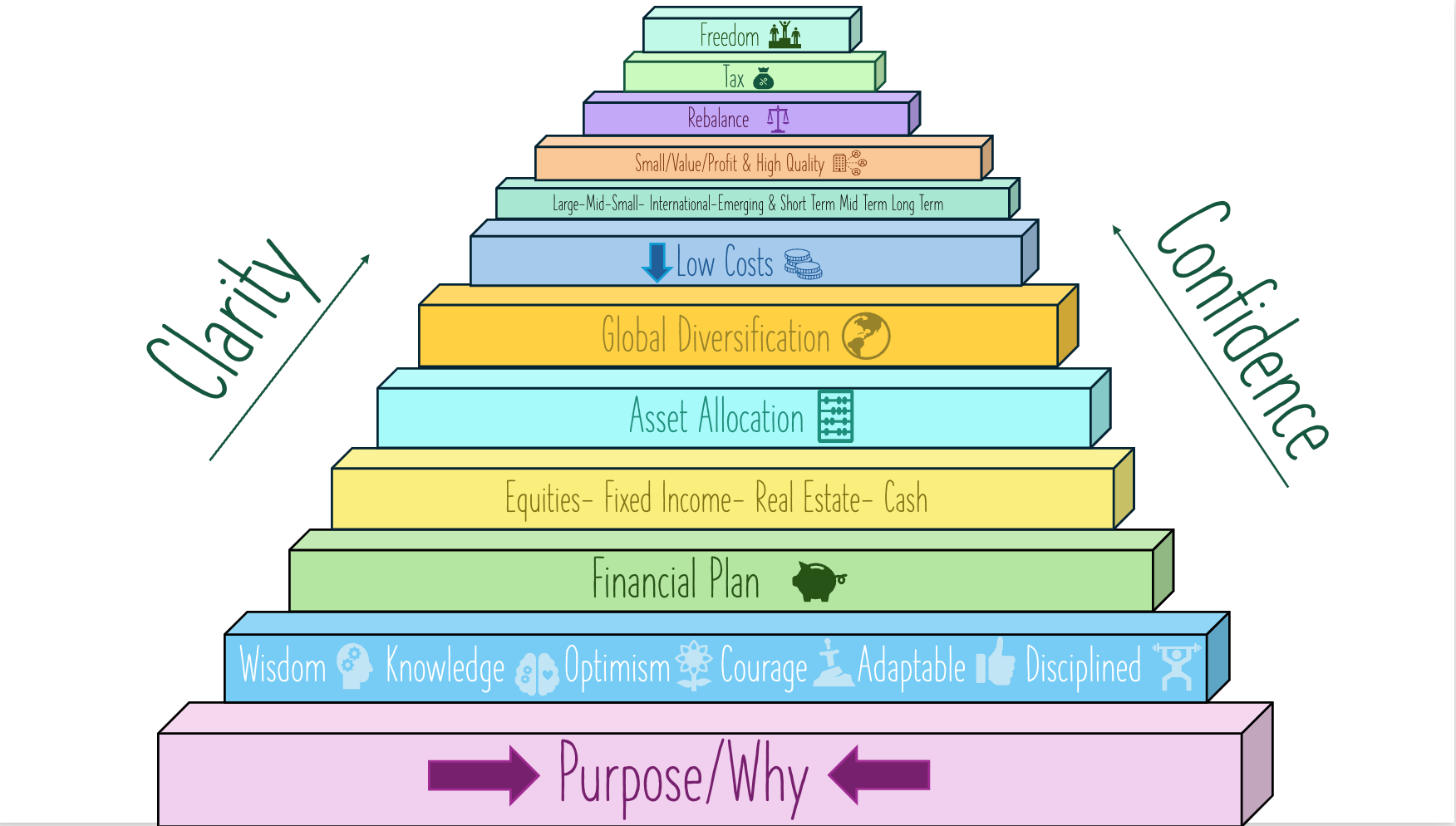

Coach Wooden was adamant about the fundamentals. And it was not just the fundamentals of basketball, but the fundamentals of living a successful life. He developed what he called the pyramid of success. For And it was reading about his Pyramid of Success that inspired me to create the Pyramid of Investing Success.

So why a pyramid? A pyramid, when constructed properly, represents a structure that can withstand the tests of time. It’s strong, stable, and built on a solid foundation. The pinnacle of the pyramid represents the ultimate goal or achievement. In investing, the same principles apply. Building your investment portfolio on a strong foundation with a focus on the fundamentals can help you weather market conditions and achieve long term success.

In today’s podcast, I’m really excited to share with you what I’m calling the pyramid of investing success. We will begin by exploring the foundation of the pyramid and then progress layer [00:03:00] by layer until we reach its pinnacle. Number one, the foundational layer. Begin with purpose. A key question to consider is what is the purpose of my money?

Why do I have it? Before we get into the technical aspects of how to invest and how to create the remainder of the pyramid, it’s important to ask this really simple but fundamental question. By understanding the purpose of your money, we’ll be able to create an investing strategy that aligns with your goals and values.

This layer is crucial because it provides a strong foundation for all the decisions you’ll make in regards to your investments. The next level up is all about your philosophy, how you think. It’s having a proper understanding of the markets and how they work. Wrong thinking creates wrong outcomes. The biggest risk to someone’s investment strategy is not what the market does.

It’s how you respond to the market during the times of fear or greed. Benjamin Graham said, The investor’s chief problem, and even his worst enemy, is likely to be himself. To have a successful investment [00:04:00] experience, it’s important to adopt a well thought out investing philosophy. Intelligent investing, as I’m going to explain, is not the same as gambling.

While it’s possible to turn investing into gambling, that’s not the approach that I This philosophy layer in the pyramid consists of several key words. Wisdom, knowledge, optimism, courage, adaptability, and discipline. And I’m, I want to explore each of these words with you. Wisdom is defined as the ability to make sound judgments and decisions rooted in knowledge.

I’ll tell you, there’s plenty of educated, knowledgeable people who are broke. Don’t take advice from those people. They’ve gathered the information, but they have not applied it in an intelligent manner. And I like the quote that says, The aim of education is not knowledge, but action. Knowledge is gathering the facts.

Wisdom is to know how to take action on the knowledge. The next word is optimism. Optimism requires you to believe that the future will be better than the present. When it comes to [00:05:00] investing, it’s a belief that businesses will continue to create and innovate and produce goods and services that will make our lives better.

And when we become investors in businesses, we benefit from the growth and success of those businesses. The next word in the layer of this pyramid is courage. There is no courage without fear or uncertainty. And every day we have a choice to make. We will choose to be courageous in the face of uncertainty, or we will choose to be fearful.

And I believe that choosing courage leads to wealth and choosing fear to poverty. As investors, we get compensated for taking risks. If you’re not willing to accept risks, then you will have to live with the returns of being safe. Playing it too safe can result in losing purchasing power to inflation.

But even worse is living a life with a constant focus on all the things that can go wrong. Always being that person to express the reasons why something won’t work. Living a cup half empty versus a cup half full approach to life. Being the person who is always ready to share all [00:06:00] the bad news, it’s just no way to live.

One way to deal with the short term volatility is to remember that you’re a long term investor, not a short term investor. Think in terms of decades, not days. The next word is adaptable. Be adaptable. Be flexible. Babies are flexible. Dead people are rigid. Don’t be rigid. And then finally, be disciplined.

Being disciplined means you have to do what you say you’re going to do, when you’re going to do it, even when you don’t want to do it. It’s knowing the difference between what you want now versus what you want most. It’s understanding that you will experience pain. The pain of discipline weighs an ounce and the pain of regret weighs a ton.

Being disciplined will help you to avoid extreme decision making such as switching from all stocks to all cash. Being disciplined will help you maintain your composure when everyone around you is losing theirs. The future is unknown and unknowable. It’s risky, life is risky, but having the right philosophy can help guide you to your desired outcomes and help you make adjustments along the way.

Having a [00:07:00] financial plan is the third layer of the pyramid and it’s the key to having a successful investing experience. A plan helps you understand if you’re on track to your destination or if you should make a course correction. A plan is your compass, your north star, a light on your path, a lighthouse in the storm.

Without a plan, it’s almost impossible to know if you’re on the right course. And you want to plan, not predict. So anytime you hear that little voice in your head saying, I think this is going to happen based on these upcoming events, recognize that you have just stepped into the realm of prediction, which is dangerous when it comes to having a successful investing experience.

We can’t predict the future, but we most certainly can plan for it. And I like to say hope for the best, but plan for the worst. I like the quote by Dwight D. Eisenhower. He says, In preparing for battle, I have always found that plans are useless, but planning is indispensable. And this quote really emphasizes the value of the planning process, even if your specific plans may change.

The next step up the pyramid is using financial [00:08:00] tools to help you achieve success. The tools I recommend you include are stocks, bonds, real estate, and cash. Now, I prefer to use low cost exchange traded funds, or ETFs, to provide exposure to various assets. When you purchase a stock, you’re essentially buying a share of a company, making you an owner.

Investing in fixed income securities, or bonds, means that you’re becoming a lender. Providing loans to governments or corporations. It makes sense to be both an owner and a lender to diversify your investment portfolio. The next asset to consider is real estate. As the song goes, buy dirt because real estate is a finite resource.

They’re not making any more of it, but also real estate in many areas appreciates in value and can be a consistent source of inflation adjusted, reliable income for people in retirement. While holding cash for an extended period is a guaranteed way to lose purchasing power due to inflation, it does have a strategic role.

The Federal Reserve’s inflation target essentially ensures that your [00:09:00] dollars lose value over time, encouraging you to either spend your money on goods and experiences or to invest it for future growth. Becoming an investor in stocks, bonds, real estate helps you to combat inflation and grow your wealth.

However, even though cash may lose value in the long term, it plays a crucial role in your investment strategy. In the short term, cash can provide a sense of security and peace of mind, helping you sleep well during market volatility and uncertainty. The next layer of the pyramid of investing success is asset allocation.

Asset allocation is understanding how much you will have in stocks, bonds, real estate, and cash. Asset allocation is simply spreading money across various assets you have available and being thoughtful to both your time horizon and risk tolerance to design an asset allocation that’s best for your situation.

For example, if you’re young and you have a lot of time on your side, you have a good job that produces dependable income, you really should embrace risk and allocate money to assets that produce the greatest opportunity for [00:10:00] growth in the context of investments, such as stocks, bonds, and real estate and cash stocks.

In most cases, have historically offered the highest returns over a long period of time. Conversely, if you’re about to retire or recently retired, you’re going to want to adjust your strategies so that your investments are best suited for this next phase of life. In retirement, you will likely be more concerned with cash flow, lower volatility, and a more conservative approach while still needing your money to work hard for you to outpace the ravages of inflation.

One key to developing your asset allocation will depend on your time horizon. Which will inform your risk tolerance. The more time you have, the more risk you can afford to take. And in retirement, you might want to consider diversifying your investments to match the time horizon of when you plan to need those assets.

Now, if you’re retiring at 60, will you plan to live to age 90? Short term market fluctuations can create anxiety, worry, and stress. And so that’s why it’s really important that you need to adjust your thinking and process information in the [00:11:00] context of your time horizon. When you become an investor, you want to think in decades, not days.

The next step is global diversification. Global diversification speaks to the idea that we don’t want to put all of our eggs in one basket. Diversification has been called the only free lunch in investing, and I’ve heard it said that the only people who should not embrace diversification are those who are 100 percent right all the time.

If we look at a table of returns by developed markets around the world, Developed markets means countries like the United States and Canada, Spain, Norway, Japan, Finland, Denmark, Austria, Ireland, Sweden, just to name a few. From 2004 to 2023, how many times during these past 20 years, do you think that the United States was the best performing equity market?

The answer, once. No country maintained the best performing market for more than two consecutive years. Determining which country’s equity market will yield the best performance is challenging. That’s why we aim for a globally [00:12:00] diversified portfolio, allowing us to capture returns wherever they arise.

Holding a globally diversified portfolio means you don’t have to guess which country will be the next winner to enjoy a rewarding investment experience. Number seven, keep costs low. Jack Bogle, the founder of Vanguard said, In investing, you get what you don’t pay for. Now, it’s important to recognize that keeping costs low is important, but paying fees for advice is smart.

I think of costs as subtracting from your bottom line, while fees should add to your bottom line. Be stingy with costs and wise with fees. As an advisor, one key way that we add value is by assisting our clients in reducing their investment costs. The Cyrano Institute out of Canada did a study that took place over 15 years, and there were a couple of key findings.

First, a report from the Investment Funds Institute of Canada highlights that, on average, investors who work with financial advisors have nearly three times the net worth and four times the investable [00:13:00] assets of those who do not. This observation holds across all age groups and income levels. The study goes on to say also focusing on a subset of participants.

In both surveys, we found that the loss of a financial advisor between 2010 and 2014 was costly. Households that retained their advisor saw the value of their assets increase by 16.4% versus only 1.7% for the assets of households that abandoned their advisors during this time. Vanguard, who has helped drive down investing costs, is a proponent of working with advisors.

And their Advisor Alpha study shows that people who have advisors earn, on average, 3 percent more per year than those that don’t work with advisors. Morningstar, BlackRock, and Vestnet PMC have all done similar studies with similar findings. And there’s an old saying that goes, don’t be penny wise and pound foolish.

Or another saying is don’t step over dollars to pick up dimes. You may think that not paying an [00:14:00] advisor fees is helping you, but the studies show the opposite. The next level in the pyramid is identifying the asset classes you want in a diversified portfolio, which will include large cap, mid cap, small cap, international, emerging market stocks, and then with bonds, you want short term, midterm, and long term bonds.

Once you’ve established a diversified portfolio that spans various asset classes, sectors, and global markets, you can then apply the investment premiums, or factors, to adjust your portfolios towards drivers of higher expected returns. To identify these investment premiums, it’s wise to consult the research from the academic community.

Factor research organizes historical data to uncover the elements that contribute to differences in returns among various groups of securities. From this research and the accompanying models, you can gain valuable insights into factors that influence expected returns and the variations of risk across different categories.

Applying these insights would involve tilting your portfolios towards small cap stocks, [00:15:00] value stocks, and companies with high profitability. These factors are pervasive across markets, observed not only in the United States markets, but also in international developed and emerging markets alike.

Additionally, for retirees specifically, it’s important to focus on high quality bonds. This means investing in debt issued by highly rated corporations and governments, while avoiding junk bonds by steering clear of companies or countries experiencing financial distress. Number 10, rebalancing is a disciplined mechanical strategy that helps investors to buy low and sell high.

By periodically adjusting the allocation of assets in your portfolio back to your target mix, you naturally sell assets that have appreciated, you sell high, and you buy assets that have underperformed, you buy low. This process helps maintain your desired risk level and investment strategy over time. I remember when we were in March of 2020, when I was rebalancing client portfolios.

That was a really scary time. There were a lot of [00:16:00] unknowns about COVID. The economy was shutting down. The stock market was, in some cases, losing 10 percent in a day. And I was rebalancing client accounts. In many instances, this meant that I was selling the high quality bonds to buy stocks. Now the bonds were our safety net.

They are the ballast. And it does not feel good to sell the safety net when things are really crazy. But the bonds had shot up in value as a result of the volatility. So the rebalancing forced us to sell bonds and buy stocks. Now, in hindsight, it’s easy to say, oh, well, that was a good move because we know that the market recovered from the volatility and that stocks made a huge comeback by the end of the year.

But in the moment when it matters. You must be disciplined to do what you agreed to do during the good times. Sell the things that have done well and buy the things that are doing poorly, because there’s a kind of gravity at work in the markets where no one asset class is consistently the best.

Eventually there’s a reversion to the mean. What was out of favor comes back into favor. Number [00:17:00] 11, be smart with taxes. Pay your fair share of taxes, but not a penny more. When it comes to taxes, I’ve found that sometimes a small hinge swings a big door and making small adjustments can make meaningful impact to your overall tax situation.

Remember, it’s not about how much money you make, but how much money you get to keep after uncle Sam gets his slice of the pie. When engaging in tax planning, it’s important to focus not only on optimizing your current year’s taxes, but also on strategizing ways to minimize your total tax burden over your lifetime.

Number 12, the pinnacle of the pyramid is freedom. When you follow the pyramid of investing success, the goal is for you to achieve clarity, confidence, and freedom. Clarity to know what’s most important and to start with purpose, to know your why. Confidence comes from having a solid plan that evolves as life progresses.

The plan allows you to assess the feasibility of your goals while acknowledging that change is inevitable. It’s essential to adopt an investment philosophy and strategy that you can commit to, regardless of [00:18:00] whether times are good or bad. And ultimately, the goal of the Pyramid of Investing Success is to experience freedom.

Freedom from fear, freedom from greed, and freedom to live your best life, spending your most valuable asset, your time, with the people that you care the most about, doing the things you want to do, and make a meaningful impact on the lives of those who will follow in your footsteps. In summary, the pyramid of investing success consists of 12 layers.

Number one is purpose. Number two is philosophy. Number three is planning. Number four is choosing the financial tools. Number five is asset allocation. Number six is global diversification. Number seven is low costs. Number eight are asset classes. Number nine are investment premiums. Number 10 is to rebalance.

Number 11 are taxes and number 12 is freedom. Put all these together and you can achieve clarity, confidence, and freedom. Few things are as important as creating a comprehensive retirement plan and a carefully crafted investment strategy. The pyramid [00:19:00] of investing success can be easy to understand, but hard to stick to when the times get tough.

However, these principles can help you to achieve your financial goals and secure a comfortable retirement. So don’t delay in taking action. Remember that time is one of your most valuable assets and it’s important to make the most of it for yourself and for those who will come after you.

Announcer: Thank you for tuning in to sound retirement radio.

For articles, links and resources from today’s show, visit sound retirement planning.com. If you enjoy the podcast, share it with a friend and give us a five star review. Ready to kickstart your retirement planning. Head over to retirement budget calculator.com. Need assistance with investment management, explore our services@parkerfinancial.net.

Information and opinions expressed here are believed to be accurate and complete for general information only and should not be construed as. Tax, legal, or financial advice for any individual and does [00:20:00] not constitute a solicitation for any securities or insurance products. Please consult with your financial professional before taking action on anything discussed in this program.

Parker Financial, its representatives, or its affiliates have no liability for investment decisions or other actions taken or made by you based on the information provided in this program. All insurance related discussions are subject to claims paying ability of the company. Investing involves risk.

Jason Parker is the president of Parker Financial, LLC, an independent fee based wealth management firm located at 9230 Bayshore Drive NW, Suite 201, Silverdale, WA. For additional information, call 360 337 2701 or visit us online at soundretirementplanning. com.