“The purpose of life is to live it, to taste experience to the utmost, to reach out eagerly and without fear for newer and richer experience.”

-Eleanor Roosevelt

Understanding the Retirement Budget Calculator

Retirement gives you the time to pursue new goals, enjoy new experiences, and make the world a little bit better. Unfortunately, financial fears keep many retirees from living their retirement years to the fullest. To help retirees assuage their financial fears, Jason developed the Retirement Budget Calculator.

This calculator can help you understand and master your cash flow going into retirement. It can help you answer the question, “Have we saved enough?” Here’s how it works.

How much do we really spend?

When you’re trying to figure out how much you’ll spend in retirement, you have to know your current spending. That sounds like an easy task, but you might be surprised by how many “unexpected” expenses you don’t remember. For example, you get your teeth cleaned twice per year. If you’re like most people you only think about dental costs twice per year, but that’s a few hundred dollars per year.

What about maintenance on your car and other “one-off” expenses? When you’re working, it’s easy to use your paycheck to pay for those expenses. However aspiring retirees need to know their spending in detail. If you don’t understand how much you REALLY spend, you’ll probably under-save for retirement.

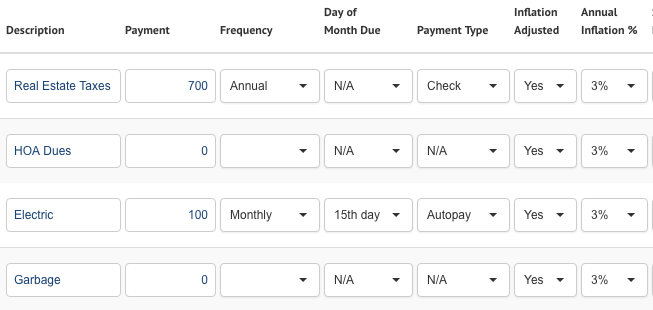

The retirement budget calculator prompts you to enter your spending in detail. You don’t just enter your housing expenses, you enter average water bill, your trash bill, your internet bill, your expected furniture expenses. By entering the details, you can get an accurate view of your real spending.

Learn how much you REALLY spend!

When do we spend our money?

You may have heard, “Cash is King.” In retirement, cash flow is king. You cannot expect to spend the same amount of money every single month in retirement. On top of paying for annual bills, you may spend extra cash for Christmas or in June when you take your vacation.

If you don’t understand when you spend money, one of two things is likely to happen. In one scenario, you may panic when you see your checking account dipping towards zero. You may even stop spending on necessary expenses like healthy foods and required medications.

In the second scenario, rather than holding onto your cash, you may spend frivolously in an otherwise low expense month.

Neither of the extremes makes much sense. During retirement, you want enough cash on hand to get you through the high expense months, but not so much cash that you’ll feel tempted to overspend. That’s why the retirement budget calculator offers a calendar view when you can see months with high expenses and months with low expenses. It can help you to plan ahead for months where you may see a deficit.

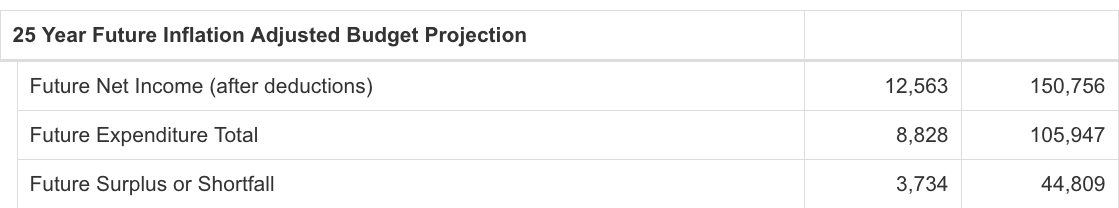

How much can we expect to spend in 10, 20 or 30 years?

While your current spending matters a lot, retirement planning requires that you understand your spending up to three or four decades down the road. That’s why the Retirement Budget Calculator gives you the tools to “predict” the future. You know that the amount you pay for health insurance is likely to rise during retirement, and it will rise faster than the rate of inflation.

Of course, you can also count on paying off your house, and no longer paying for your kid’s tennis lessons during retirement too.

For most people, their actual spending in retirement will look somewhat different than their current spending profile, and that’s okay. The Retirement Budget Calculator gives you the tools to “guess” what you’ll spend a decade or even three decades from now.

Will your guesses be perfect? No. That’s okay though. The goal of a retirement plan isn’t to be perfect. Instead, the goal is to make it easier to make adjustments to your spending, saving or earning sooner rather than later.

How will our “personal” inflation rate affect our cash flow?

Will our money last?

As you start to understand your spending habits, you can start to test your assumptions to see if your money will last. What would happen if you decided to work a year or two longer? Is your rental income enough to support your lifestyle or do you need to build up a bigger nest egg? How much does your portfolio have to earn each year to last for the next thirty years? Is that realistic?

You can use the estimates from the Retirement Budget Calculator to be a “North Star” that will help you move towards the right size nest egg. Nobody can guarantee that your savings will last, but the Retirement Budget Calculator can help you test whether your retirement plan holds water.

After all, retirement is about experiencing life. If you make a realistic retirement budget, you can step into retirement with confidence.

How much does the Retirement Budget Calculator cost?

The Retirement Budget Calculator costs $54 for unlimited access. You’ll also get access to a webinar that teaches you how to use the calculator to maximize your peace of mind.

If you’re getting close to retirement, the Retirement Budget Calculator is a great option to help you figure out when you should start writing the next chapter of your life.

Check out the Retirement Budget Calculator.