Before we show you one way to reduce taxes on social security income we need to determine if your social security income is taxable.

The easiest way to determine if your social security income will be taxable is to add one half of the social security income you received with all of your other taxable income sources including tax exempt interest. (This is called your provisional income.)

1/2 Social Security Income + all of your other taxable income including tax exempt interest (do not include Roth distributions) = provisional income

A little known, but powerful fact, is that qualified distributions from a Roth IRA are tax free and are not included in the income calculation for determining if your social security income is taxable. (This could be a one more reason to consider converting a traditional IRA to a Roth IRA. Click here to read how you can have $100,000 per year of cash flow in retirement and not pay any federal income tax.)

- If you file an individual tax return in 2014 and your provisional income is between:

$25,000 – $34,000 You may have to pay income taxes on up to 50% of your benefits.

$34,000 or more and you may have to pay income taxes on up to 85% of your benefits. - If you file a joint tax return in 2014 and your provisional income is between:

$32,000 – $44,000 You may have to pay income taxes on up to 50% of your benefits.

$44,000 or more and you may have to pay income taxes on up to 85% of your benefits.

Here are a few links to help you calculate the amount of your social security income that may be taxable.

1) IRS Interactive Calculator – Approximately 9 minutes to complete.

2) Social Security Timing – Very Fast

If your social security income is taxable, then here is a strategy for reducing those taxes:

One of the simplest ways to reduce taxation of social security is to reduce the amount of income you are receiving via a 1099, but that you are reinvesting instead of actually spending.

For example if you are receiving 1099 interest income from your bank certificate of deposit and spending the income then this little trick will not work.

However, if you have 1099 interest income from a bank certificate of deposit and you are not spending the income, but rather just rolling the interest back into the CD, then you could potentially reduce your tax liability by utilizing either tax-deferred annuities or tax-deferred savings bonds.

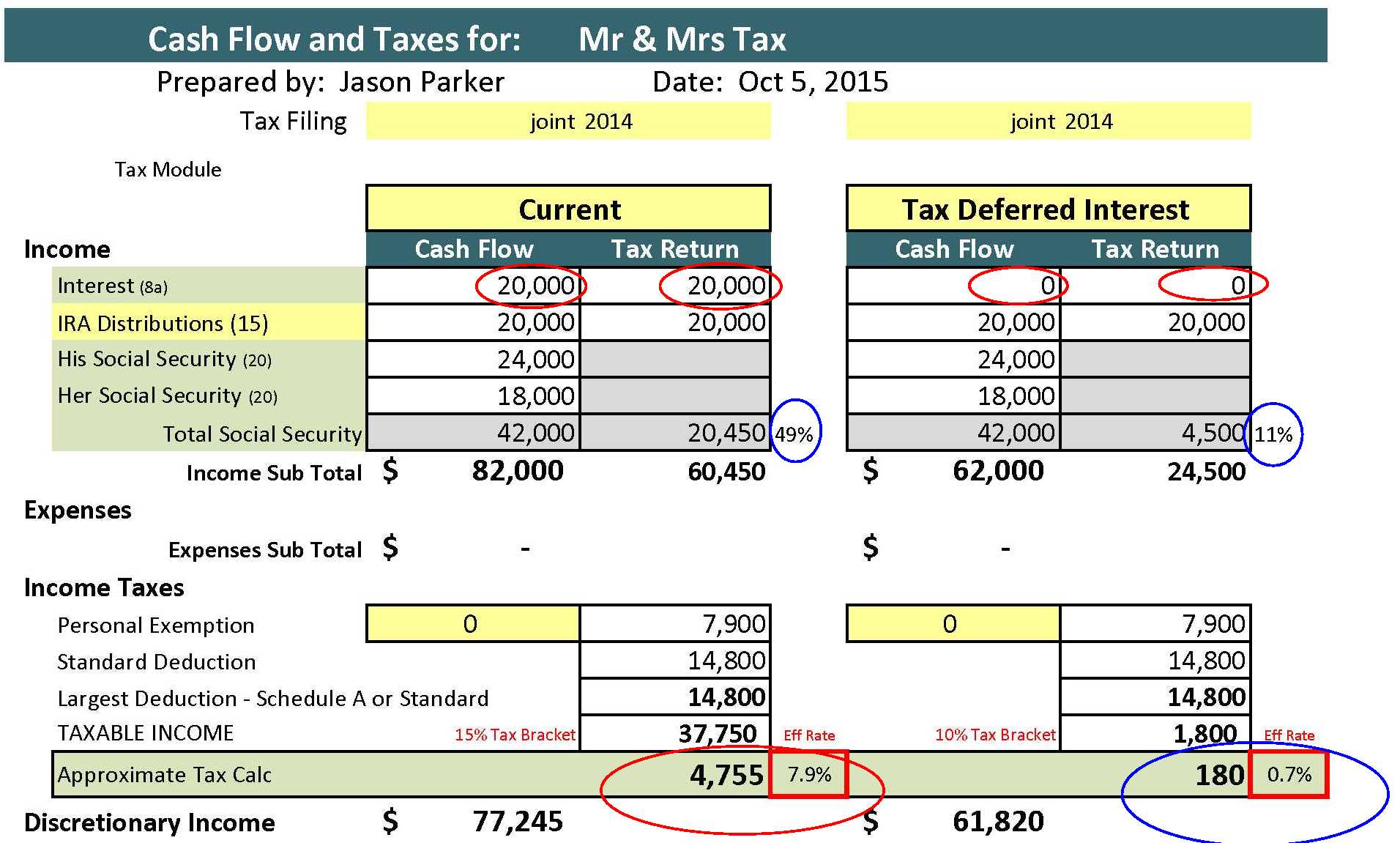

In our example below, we assume that Mr. & Mrs. Tax have $20,000 of 1099 interest income from their certificates of deposit. Mr. & Mrs. Tax explained that they do not use any of the interest income that is being generated from their portfolio of CD’s to satisfy their lifestyle needs. All of the interest income is being reinvested.

If they use a fixed tax-deferred annuity contract, then they would still earn interest on their money, possibly even more interest, and the interest income would not be included in their taxable income until they took a withdrawal from the account and received income, so no 1099 until they pulled funds from that account.

By choosing when you draw income from a fixed-deferred annuity contract, you can have more control over when you pay taxes, which you can use to influence how much of your social security income is taxable in a given year.

You can see from our tax spreadsheet below (highlighted in blue) that this simple trick could reduce the amount of social security that is being taxed from 49% to only 11% of benefits.

But even more important in this scenario is the clients annual tax bill is reduced from $4,755 per year to only $180 dollars per year. Reducing their effective tax rate from 7.9% to only 0.7%.

The shows you how income that is being reported, but not necessarily spent, can have a negative impact not just on the amount of your social security income that is taxed, but also the bottom line in terms of the amount of federal income tax you pay every year.

When creating a retirement cash flow plan be sure to take into consideration the impact taxes will have on your income.

I’ve learned that most people do not mind paying their fair share of taxes, but most people do not want to pay more than their fair share.

Social Security income has not always been taxable. Take a look at how political parties have impacted the taxation of your social security retirement income.

Which political party is responsible for the taxation of social security?

In 1983 congress voted on amendments that were proposed by the Greenspan commission to allow up to 50% of social security to be included in taxable income if certain income thresholds were met. Ronald Reagan signed this legislation in 1983 and social security retirement income taxation began in 1984. The Senate majority in 1983 was the Republican Party and the House Majority was the Democratic Party.

In 1993 legislation was enacted and signed into law under President Clinton that increased the amount of social security that could be taxed from 50% up to 85%. The Senate Majority Party was the Democratic Party. The House Majority Party was the Democratic Party.

http://www.ssa.gov/history/InternetMyths2.html

http://www.irs.gov/uac/Newsroom/Are-Your-Social-Security-Benefits-Taxable

http://www.irs.gov/uac/Are-Your-Social-Security-Benefits-Taxable%3F

http://www.ssa.gov/planners/taxes.html