Jason Parker, RICP is the founder of Parker Financial LLC, an independent, fee based financial advisor and investment firm who operates as a fiduciary and serves clients nationwide. Jason helps FERS make the transition into retirement with comprehensive analysis of their FERS benefits and integrates those benefits into a retirement cash-flow plan. To learn more about Jason and his team visit Parker-Financial.net

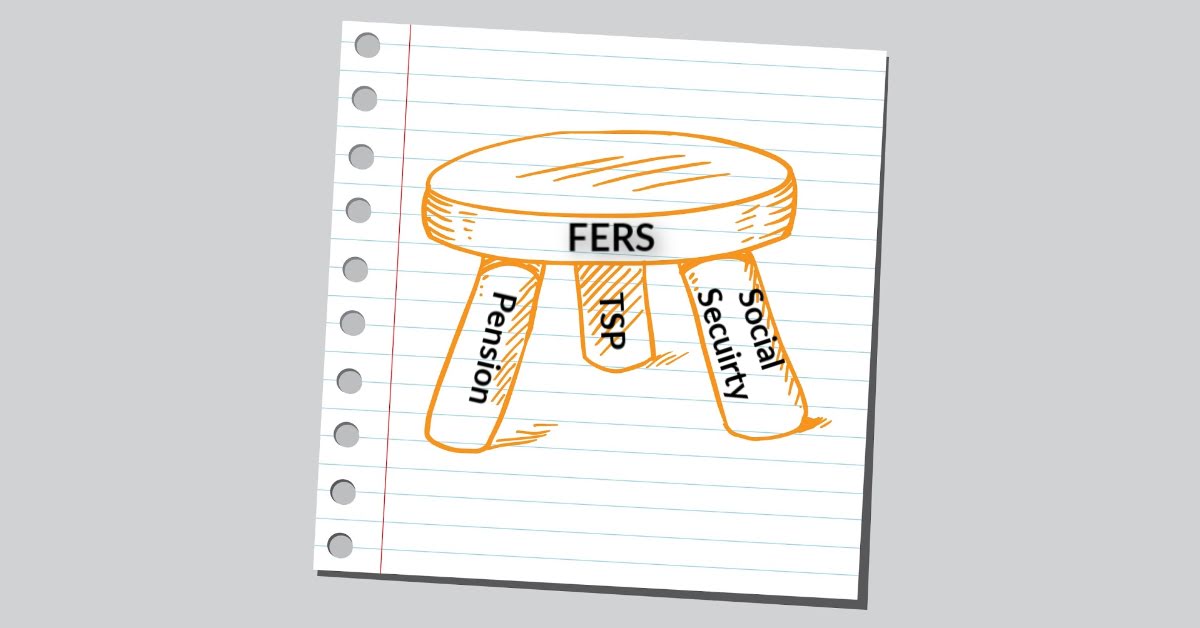

Retiring from the Federal Government requires a thorough understanding of your federal benefits, and how those benefits will work in the context of an comprehensive retirement cash-flow plan.

We have conducted webinars, podcasts and collected resources from the web that you may find helpful as you prepare for retirement from federal service.

Podcast Episode:

Guest: Dan Jamison, CPA & Author of the FERS Guide

Topics Covered:

Should you take a survivor annuity? If so which option is right for you?

Deferred vs Postponed FERS Annuity

MRA +10

FEHB

Electing a FERS Survivor Annuity

Consideration for Federal Employees who are getting a divorce

FERS Retirement Eligibility

Premium conversion and paying FEHB with Pre Tax dollars

Special Category Employees

Podcast Episode:

Guest: Chris Kowalik – Founder of ProFeds

Topics covered:

Formula for estimating the Special Retirement Supplement or social security supplement

Use sick leave toward retirement pension

Buy back temporary time

qualifying for FEHB in retirement

Taxation of FEHB before and after retirement

FERS COLA’s vs FEHB Premium increases

FEHB & Medicare work together

Federal Long Term Care Plan

TSP Modernization and access to your money in retirement

Survivor Annuity considerations

Podcast Episode

Guest: Chris Barfield, CPA BarfieldFinancial.com

Topics covered:

Barbell Strategy

Inflation on medical expense vs COLA’s

TSP Pros & Cons

FEGLI cost savings considerations

FEHB & Medicare

Survivor Annuity Spousal Benefits

Previous Podcast Episodes:

148 FERS Updates with Dan Jamison

087 FERS Retirement Planning With Dan Jamison

059 FERS Guide with Dan Jamison

FERS Retirement Webinar Replay:

Links To Resources:

FEGLI: Good article reminder for what is the difference between FEGLI Basic, A, B & C:

FEGLI: Rates increasing at 50 but double at 60:

https://www.fedweek.com/taxes-insurance/fegli-optional-coverage-gets-costly-after-age-50/

FEGLI Calculator: Use this calculator to show current cost and how they will change at age 60:

https://www.opm.gov/retirement-services/calculators/fegli-calculator/check-sheet/

Reasons to keep money in the TSP vs Moving to an IRA:

https://www.barfieldfinancial.com/new-blog/should-i-transfer-my-tsp

Special provisions LEO, FF, ATC – Reduction in FERS Supplement

https://plan-your-federal-retirement.com/fers-supplement-for-special-provisions/

A great resource for answering many of your questions about retirement from FERS

https://www.usgs.gov/about/organization/science-support/human-capital/planning-retirement

Postponed retirement means you have years of service plus minimum age and can qualify under MRA +10. This allows you to postpone FERS Pension and still be eligible for FEHB and FEGLI when you start your retirement annuity.

Deferred retirement means you may have years of service. Possibly 20 years of service but you have not met the minimum retirement age. With a deferred retirement you are not eligible for FEHB or FEGLI when starting your retirement annuity.

https://www.opm.gov/retirement-services/fers-information/eligibility/

https://www.opm.gov/retirement-services/publications-forms/csrsfers-handbook/c042.pdf

Premium conversion means paying premium pre tax vs post tax. This is default. This comes into play when you have two Federal Employees and one will retire early. The retired person could switch to the the person who is still working FEHB so that they continue to enjoy the tax benefits of paying health insurance we pre-tax dollars. Here is a link to OPM that explains Premium Conversion.

Click Here

Currently, for duel federal employees, two self only FEHB policies are usually less expensive than self plus one.

Here is a great article by Chris Barfield, CPA where he explores if you should take a FERS survivor benefit.

https://www.barfieldfinancial.com/new-blog/fers-survivor-benefit-to-take-or-not-to-take

| TSP Pros & Cons | TSP | IRA |

| Low Fees | Yes | Yes |

| Protected from Lawsuits | Yes | No |

| ROTH Conversion’s | No | Yes |

| Investment Choices | Limited | Abundant |

| G Fund | Yes | No |

| Fund Specific Distributions | No | Yes |

| Penalty Free Withdrawals for qualified retirees before age 59.5 | Yes | Maybe* |

| Qualified Charitable Distributions | No | Yes |

| Mandatory 20% tax withholding on payments expected to last less than than 10 years. | Yes | No |

| SIPC Insured | No | Maybe** |

| Only withdrawal every 30 days with a $1,000 minimum. | Yes*** | No |

| RMD Required from the ROTH | Yes | No |

| Spousal consent and notarized signature needed on withdrawals. | Yes | No |

| Limited trading window on interfund transfers – 12 noon EST cutoff time generally processed at close of business the same day. | Yes | No |

| Limited two interfund transfers per month | Yes | No |

**What SIPC protects

*** You can get 24 withdrawals a year from the TSP. If you start a monthly installment plan, you get one payment a month. In addition to the installment, you can request a single payment, no more frequently than every 30 days, so technically, that can get you 24 payments a year with 12 of them scheduled as monthly payments.