When it comes to planning for retirement, people usually start with one of two questions: How much money do I need to retire? Or How much does it really cost to retire?

Unfortunately, the exact answer to those questions requires a crystal ball. However, if you cannot find a trusted psychic to answer the questions, there is another way. Some easy work on your end can help you answer these important questions.

How much will it really cost for YOU to retire? This article will help you figure out your retirement budget. It will also offer guidance on the nest egg you’ll need to support that budget.

Start by understanding your retirement spending

Retirement planning is an exercise in cash flow management. If you can get a clear handle on what you spend, you can answer that all important question- how much will it really cost to retire?

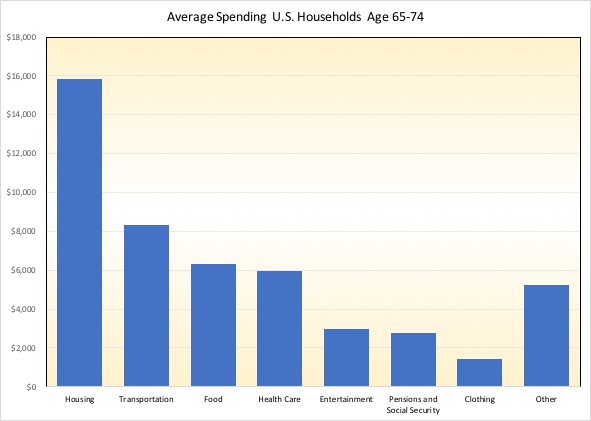

When you’re first starting your retirement budget, you may want to look at what others spend in retirement. For example, the Bureau of Labor Statistics shows that the average household of 65-74 spends just over $4,000 per month ($48,885 per year).

The annual spending breaks down like this:

U.S. Spending of Households Headed by People age 65-74- Source U.S. Bureau of Labor Statistics

Of course, knowing that the average couple spends $16,000 on housing or $6,000 on health care might help you make your financial plan, but that’s just an average. You are certainly not average in every category. And knowing averages will only get yo so far. Instead of relying on other people’s numbers, you can use your personal numbers to estimate your own cost of retirement.

That’s where The Retirement Budget Calculator comes into play. The Retirement Budget Calculator helps you understand the details of your spending. Then the software helps you estimate how much it really costs to retire.

How the Retirement Budget Calculator works

Planning out 20, 30 or 40 years of spending is an overwhelming task. But, there is a way around the problem. Simply looking at your current spending patterns can help you predict your spending during retirement.

For example, the easiest way to estimate your housing costs is to look at your current costs. You may plan to have the mortgage paid off by the time you retire, so you can put zero in the line item next to your mortgage cost. On the other hand, your property taxes and utilities costs aren’t likely to budge downwards during retirement. You can use your current spending to help set your future budget.

Of course, the estimates won’t be perfect, but looking at the detailed cost breakouts in The Retirement Budget Calculator will help you plan for the future.

For example, most people plan to increase their out-of-pocket medical expenses in their retirement budget. Even if you don’t need those funds during the first decade or two of retirement, the savings will help you later on.

Plus, planning your retirement spending can be downright fun. Many retirees aspire to spend more money on travel, theater or even charitable giving. It’s easy to build those future costs into your budget with the Retirement Budget Calculator.

You can read detailed instructions (or watch a video) on how to use the Retirement Budget Calculator to build your ideal retirement spending plan.

[youtube id=”5QvrEBO0A6A”]

Once you have a budget, what’s next?

After creating a monthly retirement budget, you still have to answer the question, “How much will retirement really cost?” The budget only explains your costs for a single month, but you need to know how much a 30 or 40 year retirement will cost.

Thankfully, planning out the next 30 or 40 years isn’t as difficult as it sounds.

If you plan to fund your retirement entirely from a portfolio of stocks and bonds, a good rule of thumb is called the 25X rule. This rule states that you have a very high probability of not running out of money in 30 years or more, if you have a nest egg worth twenty-five times your annual spending. Your annual spending is simply your monthly spending multiplied by 12.

Of course, saving twenty-five times your annual retirement spending is no small task. And this rule of thumb doesn’t account for other sources of retirement income such as income from part-time work, pensions, rental income or social security income. Thankfully, the Retirement Budget Calculator accounts for these income sources as well.

For a more detailed look at your cash flow planning, you may want to look into consulting a financial adviser that specializes in retirement planning.