Most people know that once you reach age 70.5 the IRS requires you to begin taking distributions from your IRA (Individual Retirement Arrangements.) What most people don’t realize is if you do not take the required minimum distribution (RMD) in a timely fashion every year you could face a 50% penalty. Let’s say you had one million dollars in your IRA, then your required minimum distribution the year you turn 70.5 would be approximately $36,496. If you failed to take the distribution, then the penalty would be $18,248. This is one of the steeper penalties I’ve ever encountered in the tax code. Be sure to make yourself a reminder on your calendar to take your distribution every year.

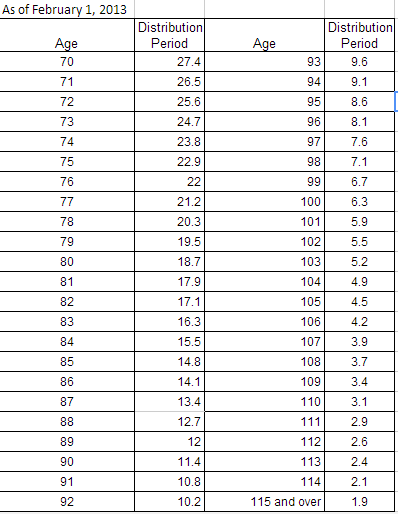

To calculate how much you need to take from your IRA you might want to visit the IRS website or consult a tax adviser. It would also be a good idea to review publication 590 to see which table you need to use for determining your withdrawal. Most of the people we have worked with over the years seem to use Table 3, which is the uniform life time table listed below. People who use this table are either unmarried owners, married owners whose spouse is not more than 10 years younger, or married owners whose spouses are not the sole beneficiary of their IRA.

To calculate your IRA Minimum Required Withdrawal you would take the value of your IRA from December 31st of the prior year and divide it by the distribution period. For example: your IRA had a $100,000 balance on December 31st last year, and you are currently 71 years old. You would determine your IRA RMD by dividing $100,000 by 26.5, and you would need to take a distribution of $3,773.59.

FINRA, the financial industry regulatory authority created a handy little required minimum distribution calculator, which you can check out by clicking here.

As always be sure to get expert advice before taking a distribution to satisfy your RMD. I’d hate to see you end up with a 50% penalty. This article was written on April 1, 2013 and it is possible that the information in this post may change. So again please consult the IRS publication 590 and a qualified tax adviser before taking action.