In 2015 Congress voted to make the Qualified Charitable Distributions a permanent part of the tax code. President Obama signed the bill on December 18, 2015. This means you no longer have to wait on Congress for a last minute deal to plan your charitable contributions from an IRA.

When you give a Qualified Charitable Distribution (QCD) directly to a charity from your IRA, you may save you more in taxes than you realize.

Now that congress has made the QCD permanent, the law allows people who are 70 1/2, who must take a required minimum distribution (RMD), to exclude up to $100,000 from gross income for donations paid directly to a qualified charity from their IRA. This is powerful because the gift satisfies the RMD and is not included as taxable income on your tax return.

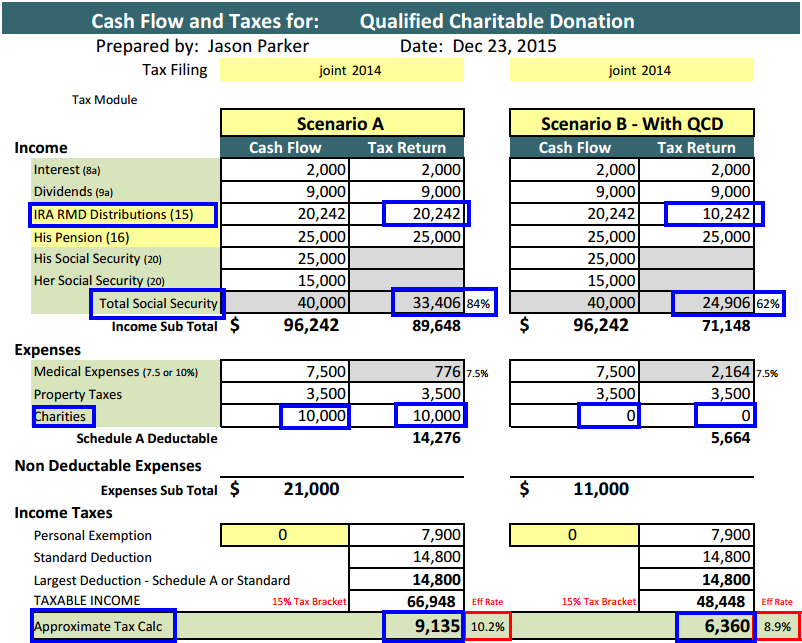

The tax savings opportunity will obviously vary greatly depending on your personal situation, but out of curiosity, I ran the numbers for a hypothetical married couple. In this example the person who gives to a charity directly from their IRA using the Qualified Charitable Distributions, paid 30% less money in taxes than the person who took the distribution, but then made a gift and itemized the gift on schedule A of their tax return.

How does this equate to a tax reduction? Well, you only have to report the taxable portion that you actually received from your RMD on line 15B of your tax return, but you get to report the total RMD amount (taxable and non-taxable to you) on line 15A of your tax return, which shows the IRS that you satisfied the amount you had to withdrawal from an IRA to avoid the 50% penalty for not taking a RMD.

In scenario A – If your RMD distribution is $20,242 and you did not use the Qualified Charitable Distributions, then you would take a distribution and report $20,242 on line 15a and 15b of your tax return, assuming these are all taxable distributions.

In scenario B – the QCD of this example — we assume the couple has $10,000 sent directly from their IRA to a charity and then took a distribution of $10,242. They would report the full distribution of $20,242 on line 15a, but would only have to include the $10,242 of taxable income of line 15b (taxable amount) of their tax return.

When you reduce the amount of income that hits the front page of your tax return, it filters through other calculations such as the provisional income rules that determine how much of your social security is taxable and ultimately impacts your adjusted gross income.

In the scenario below, I assume a married couple is age 73 and 72 and filing a joint tax return. He has $500,000 in his IRA. Based on their ages, the current RMD would be $20,242 for the year.

In Scenario A – I assume the tax payer takes the full RMD, but then turns around and gifts $10,000. They account for the gift by itemizing deductions and include $10,000 that was given to charities on Schedule A. However in our scenario this $10,000 gift was not enough to bring their schedule A itemized deductions up to the point where it matters because the standard deduction in 2014 was $14,900 which was greater than the clients itemized deductions of $14,276.

In the Scenario B – the QCD example, I assume he has $10,000 from his IRA sent directly to his qualified charity, and he then takes a distribution of $10,242 that will be counted as taxable income on his return.

In this example you will notice that one of the advantages of using the Qualified Charitable Distributions is that it reduces the amount of their social security income that is taxable. Notice that they went from having to include 84% of their social security income as taxable in Scenario A to only 62% of their social security income being taxable in Scenario B.

By choosing to give using a qualified charitable deduction directly from their IRA in this scenario it reduced their income tax liability 30% from $9,135 in the Scenario A to only $6,360 in the Scenario B – QCD.

In both scenarios the giving was the same. The big difference between each scenario was in Scenario A the couple took a distribution and then made a $10,000 gift, while in Scenario B they used the QCD to gift $10,000 directly to their charity and had a taxable distribution of $10,242 to report on their tax return.

We know a lot of people who give to their church and other charities on a regular basis. Why not get the very most tax benefit out of those gifts?

Most people do not mind paying their fair share in taxes, but most people do not want to pay more than their fair share in taxes. By using the Qualified Charitable Distributions to satisfy your charitable giving and your required minimum distribution it may help you pay less money in taxes and continue a legacy of stewardship.

Here are a few key points to remember:

- Assets must be transferred directly from an IRA to a Charity.

- Donations must be made before December 31st.

- You cannot give to donor-advised funds, charitable annuities or a grant making foundations.

- As the IRA owner you are responsible for having proof of the gift before filing your tax return.

- Married individuals filing a joint return could exclude up to $100,000 from each of the spouses own IRA’s.

- The amount excluded from gross income is not deductible.

- For higher income medicare beneficiaries making a contribution from your IRA directly to a charity may also help you avoid having to pay income related monthly adjusted amount (IRMAA) which is an extra charge added to your premiums for Medicare Part B and Part D.

Please consult with your CPA or tax adviser before taking any action on anything discussed in this article.

Here is the IRS website for more information on qualified charitable contributions.

https://www.irs.gov/Retirement-Plans/Charitable-Donations-from-IRAs

https://www.irs.gov/Charities-&-Non-Profits/Exempt-Organizations-Select-Check