Jason and Chris discuss some of the unique opportunities and planning strategies for federal employees who are nearing retirement.

Chris Kowalik is the founder of ProFeds, and a federal retirement expert and frequent speaker to federal employee groups nationwide. In her highly-acclaimed Federal Retirement Impact Workshops and FedImpact Podcasts, she and her team empower employees to make confident decisions as they plan for the days when they no longer have to work. Chris’ candid and straightforward nature allows employees to get the answers they need, and to understand the impact these decisions have on their retirement. She knows first-hand the challenges that so many face as they plan for and approach retirement. She believes that helping employees to take ownership of their decisions is the first step to making progress in meeting their retirement goals.

Below is the full transcript:

Announcer: Welcome back America to Sound Retirement Radio, where we bring you concepts, ideas, and strategies designed to help you achieve clarity, confidence, and freedom, as you prepare for and transition through retirement. And now here is your host Jason Parker.

Jason: America, welcome back to another round of Sound Retirement Radio. So glad to have you tune in back in this morning. Boy we’ve got a great show lined up, especially for our federal employees. Those folks that are wanting to retire from their federal service. Can’t wait to introduce our guest to you. But as you know, we like to get the morning started right two ways. So this morning I’ve got a joke here for you and a verse. We’ll start the morning right by renewing our mind. And this verse comes to us from Second Corinthians, verse seven. For we live by faith, not by sight. And Emilia, she found a joke. She’s not going to be with us this morning, but she found a joke for me to share with you. She thought this was funny. I don’t know. I’m just laughing at how stupid it is. What do you call a sad strawberry? A blueberry.

Jason: Episode 211 is my good fortune to bring Chris Kowalik onto the program. She is a federal benefits specialist and the founder of ProFeds. So her bio is, she’s the founder of ProFeds and a federal retirement expert and frequent speaker to federal employee groups nationwide. In her highly acclaimed federal retirement impact workshops and the FedImpact Podcast, she and her team empower employees to make confident decisions as they plan for the days when they no longer have to work. With nearly two decades of experience in the financial services industry, Chris has been a frequent contributor to national publications such as My Federal Retirement, Forbes, Entrepreneur, and Investopedia. Chris is a former active duty U.S. Marine and served as an Arabic linguist and signals intelligence analyst prior to starting ProFeds. Chris Kowalik, welcome to Sound Retirement Radio.

Chris: Jason thanks so much. What a nice thing for Amelia to find funny jokes for you.

Jason: She is good, she’s such a great person to have around here, but that joke, it took me a second to figure it out. A blueberry, a sad berry [inaudible 00:02:30]. Anyways Chris, this is going to be a good show. Thank you for your expertise in this area of federal employees benefits. And what I wanted to do today, if it’s okay with you, is just really start to dig into some of these benefits that are specific to people that are FERS employees that are wanting to retire. But before I do, I just want to ask you. Why are you so passionate about this?

Chris: I see the challenges that federal employees have in navigating all of these benefits. And I just don’t think planning for retirement should have to be this hard. So with all of these benefits, which with their natural complexity, it oftentimes causes people to freeze and not take action. So I started ProFeds to try to help empower federal employees to feel confident about the decisions that they’re making. And I absolutely love what I do. I hope your listeners are ready because I could talk about federal benefits all day long. So let’s get started.

Jason: I’ve been in some of those training sessions with you where you have talked about federal benefits all day long, and you are excited about it, you’re passionate about it. And at the end of the day, you’re going as strong as you are at the beginning. So let’s start with a unique opportunity that federal employees have, some federal employees have, which is the Special Retirement Supplement. Tell our listeners what that is and how it works, and can they be confident that it’s still going to be there for them in six months or a year?

Special Retirement Supplement

Chris: Definitely. So the Special Retirement Supplement is a program that’s unique for our FERS employees. So these are newer federal workers hired 1984 or later.

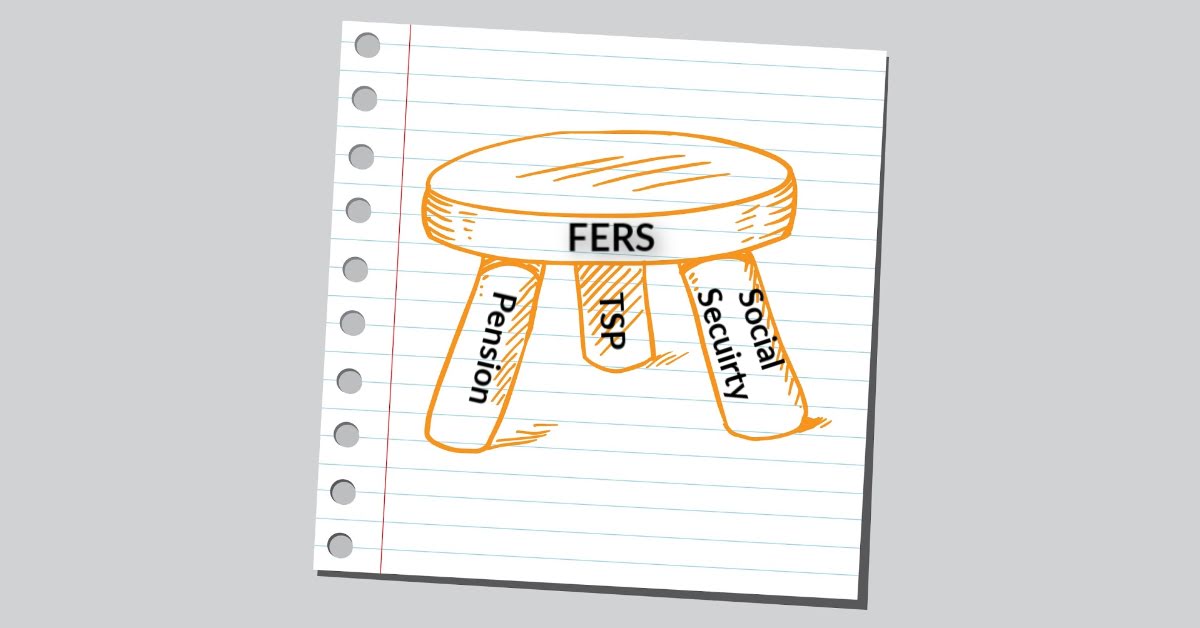

Chris: So when we think of the retirement system that they have and that Congress put in place for these employees when they switched from the old system to the new system, it was basically a pension, social security, and the Thrift Savings Plan. But federal employees have the capacity to retire prior to the age of 62 when they’re eligible for social security. So during that time, say from 56 when they retire up until 62, there was no social security paid. So the Special Retirement Supplement was a program designed to bridge the gap when an employee retires prior to age 62, I’ll say most employees when they retire prior to age 62. Up until the time they turn 62 when social security can begin.

Chris: Now this program mimics social security in a lot of ways. In fact, it’s based on the age 62 social security benefit number. So there’ll be a formula to determine what percentage of that age 62 social security benefit should be paid, prior to attaining that age from this special program.

Jason: Okay.

Chris: But you make a really good point and that is that employees are often wondering is this program going to stick around? And it’s been in effect for a long time, but it always seems to be on the chopping block for Congress to take away. So I think employees are smart to hope that it’s there, but plan for it not to be there just in case Congress decides to stroke that congressional pen and make a sweeping change to a program like this.

Jason: Good point. Yeah. We always like to say hope for the best, plan for the worst. What about the simple formula? Do you have any way of estimating how much people might be able to collect through the Special Retirement Supplement?

Estimating your Special Retirement Supplement

Chris: So the formula to calculate this would be taking an employee’s number of FERS years that they’ve had, not including military time or anything like that, but just regular FERS years divided by 40. And that will tell an employee about what percentage of the social security benefit number that’s estimated for age 62 that they’ll actually receive in the form of the Special Retirement Supplement prior to that age.

Jason: All right, great. And we should let our listeners know one of the reasons that we have an emphasis on helping federal employees with retirement. We help people from all walks of life, but specifically here in our community and where my office is in Silverdale. We have the ship yard, we have Bangor, which is a sub base. We have a lot of people that choose to retire, retired military that retire here to this area. So we just have such a huge demographic of people that are retiring from the federal government. So we wanted to be able to bring them first class education, all day workshops so that they can really make educated decisions about the best way to plan for their retirement.

Jason: So I’m really excited to be able to let our listeners know that we have an upcoming, it’s called the Federal Impact Workshop happening right here in Silverdale. You can learn more about the workshop if this is something that you think you would be interested in attending. And boy, I’ll tell you the last time we did one of these, we had people drive from three hours away. There is limited seating for these. The capacity of our room, we can only have about 40 people there comfortably. But if you want to sign up, if you want to learn more about it, of course we’ll have a link at soundretirementplanning.com or you can go directly to the registration page, which is fedimpact.com/jrp. J-R-P, like Jason Randall Parker.

Making a deposit for temporary time

Jason: Okay, Chris. So the Special Retirement Supplement is, pretty cool. Pretty neat opportunity for people. At this point, it looks like it’s still going to be there for people that are retiring early. The second thing I wanted to talk to you about, and I wanted to talk to you specifically because we had the good fortune to meet with a federal employee. She was under the impression that she was not going to be able to buy back time. And after we went through an analysis, we found that she would be able to potentially buy back that time. So talk to our listeners about this opportunity that exists and how the law changed back in 2009, 2010 to allow people to buy back time. What do we mean by that? When we use that phrase buy back time?

Chris: Yeah. So when we’re thinking of buying back time, that means there was a period of federal service that an employee was working but was not contributing to the retirement system. So buying it back essentially says had I been contributing all those years ago into say FERS, what would I have contributed? Plus all the interest on that. And that’s the buyback or the “deposit,” that’s the official name for it.

Chris: So in this case that we reviewed together, it was a scenario where someone had some bad information. They had misinformation that at one time was true, but is now no longer true. And that’s because with the National Defense Authorization Act of 2010 that was signed in 2009, went into effect in 2010, it had sweeping changes specifically to the FERS retirement system. So this is when FERS employees were now eligible to use their sick leave towards their retirement pension. That was part of that change. And another one of the changes was the one that you just mentioned was the ability for FERS employees to buy back a certain segment of any temporary time that happened prior to January 1st of 1989. So if it happened after that, FERS employees can’t make a deposit for temporary time that they had. But prior to that, which was the case of your client, that gives her an opportunity to do two really important things. The first is those years count for eligibility purposes. So she might be able to retire sooner than she originally thought. The second thing is by adding additional years into her pension calculation, of course that’s going to go up. And it goes up significantly the more years that you have.

Chris: So it’s so important, aside from just the deposits and the buying back time and everything, I can’t stress how important it is to make sure that you understand the rules that apply

today. Not what used to be true or what might be true for your boss or one of your coworkers that might be under different circumstances. But what’s actually true for you. So I hope all of our listeners really take that to heart and don’t rest on your laurels and just believe that what you thought was true many years ago is still true today. Make sure that you’re operating under the correct rules.

Jason: Boy, that’s so important. And one of the great things about bringing people together in the educational all day training session that we facilitate for federal employees is that you get to hear a lot of the questions people ask. And you’re right. There’s a lot of misinformation out there, and it can be complicated, so it’s important that we’re giving people good information.

FEHB – Health Insurance

Jason: I want to transition into health care, health insurance, because federal employees have a really a pretty neat opportunity to be able to continue health benefits into, healthcare insurance into retirement. Will you take a minute and talk about healthcare and how that works in retirement for federal employees?

Chris: Definitely. This is an area where we have so much misinformation of people making things up of what they think this is going to look like in retirement. It is important first of all, to make sure that an employee is first eligible to carry their health insurance in retirement. So there are two rules. The first is they must be retiring on an immediate annuity, meaning their pension begins right away. The second is they must have had that FEHB coverage in some form. It doesn’t have to be the same carrier or the same plan, but in some way, shape, or form for five years immediately prior to retiring. And they must be enrolled in it on the day that they retire. So don’t go out and do anything crazy like cancel your FEHB to switch to your spouse’s plan or something like that when you’re really close to retirement. We want to make sure to preserve this amazing benefit.

Chris: So one of the most common misconceptions that we have about FEHB in retirement, so this is the Federal Employee Health Benefits Program is that, the misconception is that the government no longer picks up part of the premium. And that’s not true. The government’s going to continue to pick up about 72% of the overall premium, varies a little bit between plans. But they’re going to keep doing that in retirement.

Chris: But here is the big thing that most people don’t know that comes in like a wrecking ball in retirement. And that is while you’re working, you don’t have to pay tax on your FEHB premium that you pay to Blue Cross or Kaiser or whoever your carrier is. But once you step into retirement, you lose that tax privilege. And now that’s all taxable income. So if it costs you $6,000 a year while you were working to have say the Blue Cross Blue Shield plan. In retirement, it might actually cost you about 8,000 depending on what your tax bracket is. Because you’re going to have to have 6,000 leftover after you pay the tax on it to be able to pay the premium.

Chris: So taxes can be the carbon monoxide of financial planning if we’re not careful. If we don’t anticipate what taxes are happening to us at various stages in our life as we plan for retirement, we can be surprised.

Jason: Boy, that is so important and it gives me a reminder. I want to talk to our listeners about real quick because Chris, I think you know this, but we invented some software called Retirement Budget Calculator to help people plan for a better retirement. And I had a person reach out to us recently and the point of his, the reason he reached out to us was because we had done some consulting with him. And the numbers that I was coming up with at the end of his retirement compared to what he came up with were off by about a million dollars. That’s a big swing and a big discrepancy. And he said, “Jason, how can I be so far off?” And it was taxes. He had under estimated the tax liability. So you’re right, that is something that people, they’ve got this needy uncle out there that wants a piece of all these dollars from their retirement plan if it’s IRA money. But yeah, 72%, that’s huge.

Jason: Now one of the other things when we met last at a training session that you are doing in Illinois, we had an opportunity to talk about the impact that inflation has on both a pension, as well as how, and cost of living adjustments on a pension. But also how inflation has impacted health care. And this was such an eye-opener for me. Will you take a minute and talk to our listeners about those two elements, the inflation COLA on the pension and then also inflation on healthcare?

Cost of living adjustments

Chris: Definitely. I’m going to add one more in there just so everyone is really, really clear. When an employee is still working, and their pay changes say every January, that is a pay raise increase. That is not a COLA. In retirement, those changes to the pension are called COLA’s, or cost of living adjustments. Pay raises and COLA’s are based on two completely different factors. One is automatic, one has to be approved by Congress. So a pay raise is very political and who knows if employees are going to receive it. But a cost of living adjustment on a retirement pension from CSRS or FERS is determined by the Bureau of Labor Statistics. So they’re going to look at the actual cost of living for a “basket of goods.” And that is how the pension is going to be increased for those who are already retired from federal service. So I don’t want our listeners to confuse those two. Pay raises and COLA’s, two very, very different things.

Chris: But to your point, don’t we all wish that our income and expenses could just stay at whatever that same ratio is all the way through retirement? Because that would be really predictable for us to plan for. But that’s not how this works at all. So the pension each year, the retiree is receiving a cost of living adjustment. Now some years it’s zero. But every year it’s calculated, it’s an automatic calculation. It’s automatically applied. And that goes on in perpetuity.

Chris: The 10 year average for cost of living adjustments is about 1%. It’s just north of 1% for both the CSRS and the FERS programs. But other benefits go up at an exponentially faster rate, like health insurance. So the 10 year average increase for health insurance premiums under the FEHB plan are almost 5%. So your pension only goes up by maybe 1% each year on average. But the health insurance premiums go up by 5%. I can see why retirees are scared that eventually that FEHB premium is going to overtake the pension. The pension won’t be high enough, for some employees. It won’t be high enough to cover the premium for FEHB.

Chris: So this is something we’ve got to get our head wrapped around if we’re going to be honest with ourselves about the real effect of inflation on things like this in retirement. And it’s not always just inflation, it’s just the rising cost of healthcare that continues to skyrocket. We’ve got to be able to take that into account. And if we don’t, we’re fooling ourselves that we’re going to have enough money in retirement to be able to pay for it.

FEHB & Medicare –

How they can work together

Jason: Yeah, and I think there was even an example given from one of the people that were attending where there was a woman who was in her nineties. And she was actually, her pension was no longer enough to cover the cost of healthcare. So she was actually having to kick in a little bit extra, which that’s just that can be, yeah, that’s shocking. I wanted to another area, and I know we’re covering a lot of ground here and some of this stuff can be kind of technical, but this is the reason that we do this all day workshop for folks. But there’s some confusion around Medicare and when people enroll in Medicare, do they keep their first benefit as a standalone or do they enroll in Medicare and also have the FERS supplement? And you talk about something called the super supplement. Talk to us about this decision that people need to make regarding Medicare and their FEHB.

Chris: You bet. So with retirement comes lots of decisions. One of those is this important decision at age 65 of what to do with the Medicare Part B decision. Part A is easy because it’s free and you might as well enroll in it because you’ve for it all of these years while you’ve been working. So that’s the easy one. But B is more complicated because there’s a premium along with it. And let’s be honest, who wants to pay another health insurance premium when you’re retired?

Chris: So there’s a big decision. And what I fear that a lot of people don’t grasp about Medicare and this FEHB coverage and how the two work together, is that they don’t understand what happens when you don’t have one or the other. So someone could basically take three stances. They can keep FEHB by itself and say no thank you to Medicare Part B. They could do the exact opposite and just have Medicare Part B and cancel FEHB forever. Or they can have a hybrid.

Chris: So when you have a hybrid, you have both the FEHB plan and Medicare Part B, and they work together in a really interesting way. So for all of our listeners who have seen the Medicare Part B and the supplement commercials on TV, typically towards the end of the year when open season is happening. You’ll hear them talk about a supplement replacing the part of the cost that Medicare doesn’t pick up. So Medicare picks up about 80% of their approved charges. So if all you had was Medicare, you would be responsible for the other 20% out of pocket. Well when you have a supplement like the one you can see on TV a that anyone can purchase, that supplement is designed to pick up the other 20% of the approved charge.

Chris: Here’s the problem. There’s lots of things that Medicare doesn’t cover. So that’s where the FEHB program really looks like a super supplement. And what I mean by that is if there is a charge that Medicare deems as unacceptable. A particular type of service that is rendered there, and there’s a long list of things that Medicare doesn’t cover. So if you experience one of those, then Medicare is not going to pick up any of it. They’re not going to pick up the 80%. They’re not going to pick up it at all. So if all you had was a regular supplement, it wouldn’t pick up anything either. But with FEHB, as long as it’s an approved charge by the carrier of the plan that you have, you have the ability to have FEHB step up to be your primary for that transaction. And there may be still co-insurance or something of that nature, but you’re limiting a lot of risk that you have in retirement for these big catastrophic cases, these medical situations.

Jason: So we’re out of time for our radio listeners. You had agreed to come back for some additional bonus time for our podcast listeners. But thank you so much for being a guest on Sound Retirement Radio today.

Chris: Off course, happy to be here.

Speaker 1:Information and opinions expressed here are believed to be accurate and complete, for general information only, and should not be construed as specific tax, legal, or financial advice for any individual, and does not constitute a solicitation for any securities or insurance products. Please consult with your financial professional before taking action on anything discussed in this program. Parker Financial, its representatives, or its affiliates have no liability for investment decisions or other actions taken or made by you based on the information provided in this program. All insurance related discussions are subject to the claims paying ability of the company. Investing involves risk. Jason Parker is the president of Parker Financial, an independent fee based wealth management firm located at 9057 Washington Avenue Northwest, Silverdale, Washington. For additional information, call 1-800-514-5046 or visit us online at soundretirementplanning.com

Jason: Okay, very good. So this is podcast extras. Thank you for being a guest on the radio portion of the program for people that were driving down the road in Seattle. But boy, this is so, so beneficial. And I just want to remind our listeners one more time for the federal employees. And Chris, I was just amazed at so many people from around Western Washington, as far as three hours they drove to come to one of these classes. This is really important and people want to make sure they’re getting these benefits right. But the next workshop, if they’re interested in attending, they can go to fedimpact.com/jrp to register. Or we’ll put a link directly on soundretirementplanning.com over on the right hand side. So if that’s easier for them to find, we’ll have a link there as well.

Federal long term care

Jason: But the next thing I wanted to talk to you about is long-term care. This is something that one of the things we hear from people, as I say, they never want to become a burden to their family physically or financially. There is a federal long term care program that’s available. And one of the things that we talked about was the fact that it’s a group plan, which means that there are some pros and some cons that go along with that. But will you take a minute and just talk a little bit about the Federal LTC Plan?

Chris: Absolutely. And let me share with our listeners that I could not stress more the importance of having a plan with a long-term care event happens to you. I cannot stress this enough. I have a father-in-law who has been through a catastrophic medical event. He is in a skilled nursing facility now. There’s a plan in place. We know exactly where the money is, how to pay for it. So whether you go with a Federal Long Term Care program or a private product, or maybe one of the more creative solutions that are out there in the marketplace, do something.

Chris: So with respect to the Federal Long Term Care program, this is a group long-term care product, which essentially means that like any employer who might offer a benefit program like life insurance or certainly long-term care, the risk is spread out amongst the entire group. So there’s typically not underwriting for an employer sponsored plan, but there is under the Federal Long Term Care program right now. So very important that employees realize that you can’t just sign up for this, you actually have to qualify with your health to make sure that you can get this type of plan and coverage in place.

Jason: Okay. Boy, I’m so glad you put the emphasis there too. Especially, I’m sorry to hear you’re going through this with your father-in-law. We’ve gone through this long-term care with people as well. And it is nice to know that you have a plan in place and that there’s a way to help pay for these costs. Because I don’t know how much it costs out where you live, but out here to be in the highest level dementia care unit, you’re looking at 13 to $15,000 a month in some cases. So it can get really, really expensive really fast.

TSP updates

Jason: Another thing that happened recently is some updates are going through with TSP. Can you talk for a minute about maybe some of the things you see happening with the TSP that are a positive as a result of some of these changes that will be taking place?

Chris: Absolutely. So with every one of the changes that the government ever allows to happen with any kind of benefit, whether it’s under the CSRS or FERS benefits or the insurance benefits, or the Thrift Savings Plan, there’s always good and bad. And it depends on how you’re looking at the change.

Chris: So overarching, the withdrawal changes that are being made with the Thrift Savings Plan, they’re essentially trying to make it easier for employees to gain access to their TSP money. So while they’re working, they’re making it easier to access. It used to be limited to one time after the age of 59 and a half. And then once you retire, you were limited to other withdrawal rules that got complicated and it made you feel like your money was tied up.

Chris: So on the surface, it sounds like a really great idea that you have more access to your money. But, if you are not disciplined in the way you utilize that access to money, this can actually work against you in retirement. So sometimes it’s nice to have things locked away that are a little bit harder to get to because it helps you to resist the urge to tap into that money prematurely or for things that aren’t really “worth it” to take away that retirement income that you will ultimately have. So there’s always two sides to that coin. And while the TSP is making efforts to make it simpler to access the money, what we don’t want our employees to access it more frequently for the wrong reasons, and then find themselves not having enough money once they finally retire.

Jason: Yeah. The benefit of having and working from a plan. I always tell people a plan is not something you do and then you never think about it again. You need to be updating it, and thinking about it, and tweaking it, and making sure that you’re still on track. Because you’re right. I think the biggest fear people have is making a mistake in retirement Chris. The second one after that that we find is not just making a mistake, but also this fear of running out of money in retirement. That’s a big one.

Chris: Huge. Both of those are huge, and they play such a role in the decisions that people are making or the lack of decisions that people are making as they get close to that retirement timeline.

Jason: What are some of the common themes that you see are coming up with feds as they’re doing planning for retirement? As you’re speaking with people around the country, what are some of the common concerns people have?

Chris: Yeah. First one is they wait way too long. They wait way too long to understand what they have, to understand what things look like in retirement, and what the consequences are of their choices. They just wait too long. And you and I both know, when a client walks into your office or someone who wants to be one of your clients walks into your office. If they’ve got some time on their side, you can move the earth for them. But if they are right on retirement’s doorstep, there is just nothing that you can really do. You’re in damage control mode at that point instead of opportunity mode. So I cannot stress enough how important it is for people to plan early.

Chris: The second thing is that they don’t ask for help. They think everything will be fine. “Hey, I’ve had these government programs for all these years. It’s been good to me so far. It’ll probably be good for me in retirement too.” And that’s just not the way these benefits are structured. They’re amazing in a lot of ways, especially while an employee is still working. But stepping into retirement flips a little trigger on these benefits that causes them to behave differently in retirement. And I think employees owe it to themselves and to their families to know what that is so they don’t get caught with benefits that they thought were going to operate one way and end up operating a completely different way that’s not in their favor in retirement.

Jason: Yeah, that’s really good. One last question for you. I know you’ve got a busy day there, and I’ll let you get back. I just want to ask you one last question because this is a big one and especially for married couples. There’s a decision that they have to make about electing a survivor option on their pension. And will you take a minute and just maybe help our listeners understand this decision and why it’s so important for them to really be thinking this through?

Survivor benefits program

Chris: Definitely. So the government essentially is providing a pension to the retiree, based on your work history, and your pay, and all of that. There’s a big formula and we come up with a number that the employee is going to receive once they retire. The question with the survivor benefit program is what percentage of that pension does the spouse want to keep getting once the retiree dies? And Jason, if you had to take a wild guess, what percentage would espouse prefer to keep getting?

Jason: 100%.

Chris: 100%. That’s what they say every time.

Jason: Most of them don’t want less money in retirement, and they don’t like the idea of paying more money in taxes when one of them passes away either. But unfortunately, that’s what happens most of the time.

Chris: Exactly, exactly. So what I want all of our listeners to understand is the government is only willing to be so gracious. At max for a FERS employee, the most the government is willing to protect for us spouse is half of the pension. That’s it. So if a spouse says, “Well gosh, based on this budget software that I just ran with Jason, I’m pretty sure that I’m going to need all of that money to keep coming in even after my husband or wife dies.” Well, they’ve got to have a different plan. They’ve got to have a different way to make that money appear upon the death of that employee or retiree at that point. If they don’t, they’re going to experience an income deficiency that will be really hard to recover from that late in life.

Jason: Yeah.

Chris: Okay? So in addition to the actual income part, there’s another facet to this decision that is so very important. And that is that in order for a spouse to continue to receive health insurance after the retiree dies, they must be named as a survivor annuitant, meaning the retiree had to have made an election on the retirement application that says that spouse is going to receive at least something from the CSRS or FERS benefit.

Jason: That’s so good.

Chris: It’s huge. And we see financial planners that don’t know what they’re doing in this space of working with this amazing group of people give terrible advice on that type of thing. They may say, “You don’t need that, don’t worry. There’s plenty of income over here. Just say no things to the survivor benefit,” without understanding what that consequence is. We might not have an income problem if we’ve got that taken care of some other way, but we do have a health insurance problem. And depending on what the spouse’s health is at that time, we might have a really big financial problem if they’re having to pay out of pocket.

Jason: So important to understand that these things can be interconnected, and that having a plan, having a plan. So many people are just making decisions about asset allocation and diversification, and they’re buying financial products and tools, but they really have no plan that they’re working from. They’re not thinking about how this all works. And Chris, we are so grateful for the work that you’ve been doing at FedImpact and at ProFeds to help educate advisors so that the advising community can help the people that we serve make better decisions as they’re making this transition into retirement. So thank you so much for the work you’re doing. Any final thoughts for our listeners before we finish up today?

Chris: Well, I couldn’t be more thrilled to have been here with you today. I’ll kind of throw that right back to you, which is thank you for the service in being able to sit down face to face with employees and help them to wrestle with all of this complexity, and making sense of it all so that they do have a plan. They do have a path forward. So I thank you for your leadership in that process, and I couldn’t be more excited to come back to Silverdale and do those workshops. We’ve got an amazing training team, and they just have the greatest time there. So I know any of our listeners who are interested in attending that workshop, I assure you it’ll be well worth your time, and your thoughts and energy that go into that day. Will be the starting point of a massive transformation if you do the work and you get your head in the game when it comes to planning for retirement.

Jason: Awesome. Chris Kowalik, thank you so much.

Chris: You are very welcome. Thank you.

Jason: Take care.

Jason Parker is the author of Sound Retirement Planning, the host of Sound Retirement Radio and the President of Parker Financial LLC an independent fee based registered investment advisory firm in Silverdale WA and operates as a fiduciary. His team enjoys helping federal employees make the transition into retirement. Learn more by visiting Parker-Financial.net